Mitigating the Growing Impact of Student Loan Debt

Irene LewCarolina RodriguezPatrick JosephEmerita Torres

Context

Student loan debt has reached $1.7 trillion in the United States and is the second largest form of consumer debt next to mortgages.[1] In New York State, approximately 2.4 million people owe more than $98 billion in student debt, with one million of these borrowers living in New York City. Prior to the COVID-19 related economic downturn, 43 percent of all federal student loans were considered “in distress” because they were either delinquent, in default, or total loan balances were increasing.[2] To support student loan holders during the pandemic, the federal government suspended payments on all U.S. Department of Education-owned student loans in March 2020; President Biden recently extended the freeze on student loan payments for a third time. However, once this relief ends in 2022, we can expect the number of borrowers in distress to increase significantly.

In this brief, part of the series Whose Recovery? Addressing the Needs of Low-Income New Yorkers, we focus on New Yorkers who are disproportionately impacted by student debt and the hardships that they face because of their debt and provide key findings and policy recommendations.

Summary of Recommendations

- Make public college more affordable for low- and moderate-income students by expanding eligibility for New York State’s Tuition Assistance Program (TAP) and providing state-funded grant aid for non-tuitionrelated expenses: The State should create a state-funded grant aid program, modeled after CUNY ASAP, that provides coverage of nontuition expenses for low-income students. We commend Governor Hochul’s recent proposal to expand TAP funding and eligibility as a necessary and critical first step.

- Pass The New Deal for CUNY (S.4461-A/A.5843-A):[3] The New Deal for CUNY upends the burden of student debt for 270,000 New Yorkers. By passing this legislation, New York State would make admission to the City University of New York free for in-state students. This change to tuition would be a return to a policy that stood for more than 100 years prior to 1975.

- Funding student Loan Consumer Assistance Programs (CAPs): The federal and state government should establish and fund more consumer assistance programs, like CSS’s Education Debt Consumer Assistance Program (EDCAP).[4]

- Align student loan bankruptcy rules with those for regular consumer debt: Congress should enact legislation to amend the U.S. Bankruptcy code to allow student loans to be discharged in bankruptcy more easily, and without the need to prove undue hardship.

- Reform current federal loan programs to assist those most in need: Reform student loan repayment plan guidelines to reflect the cost of living and reduce the length of forgiveness programs so that borrowers can avoid entering repayment plans they cannot afford and eliminate their student debt.

Key Findings

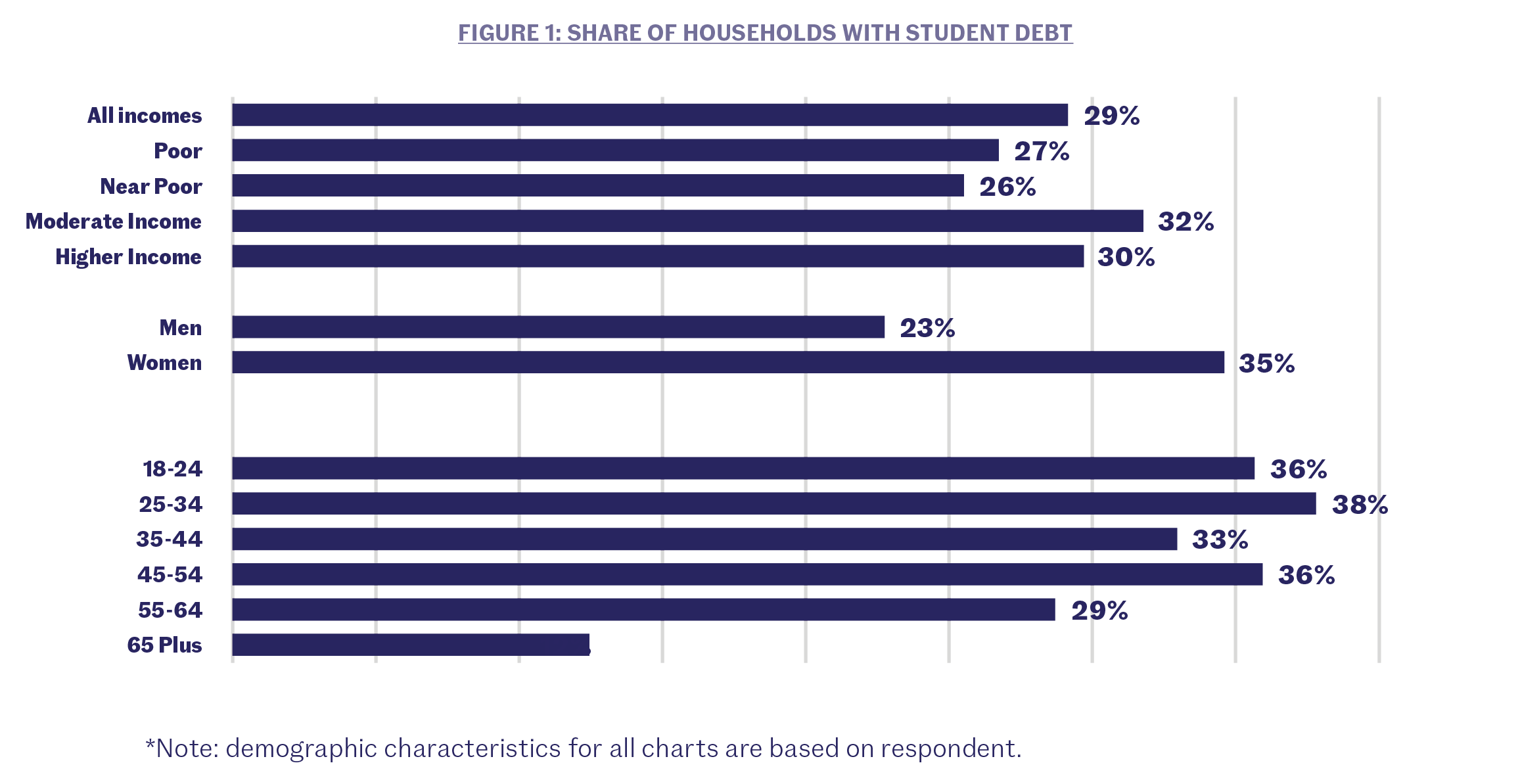

- Student loan debt is not just a challenge for young people and those with higher incomes; it is common across the age spectrum and for those at the bottom of the income ladder. More than a quarter of New Yorkers living in poverty said that they or a member of their household had student debt. Over a third of older New Yorkers aged 45 to 54 said that their household had student debt, similar to the share of New Yorkers aged 25 to 34.

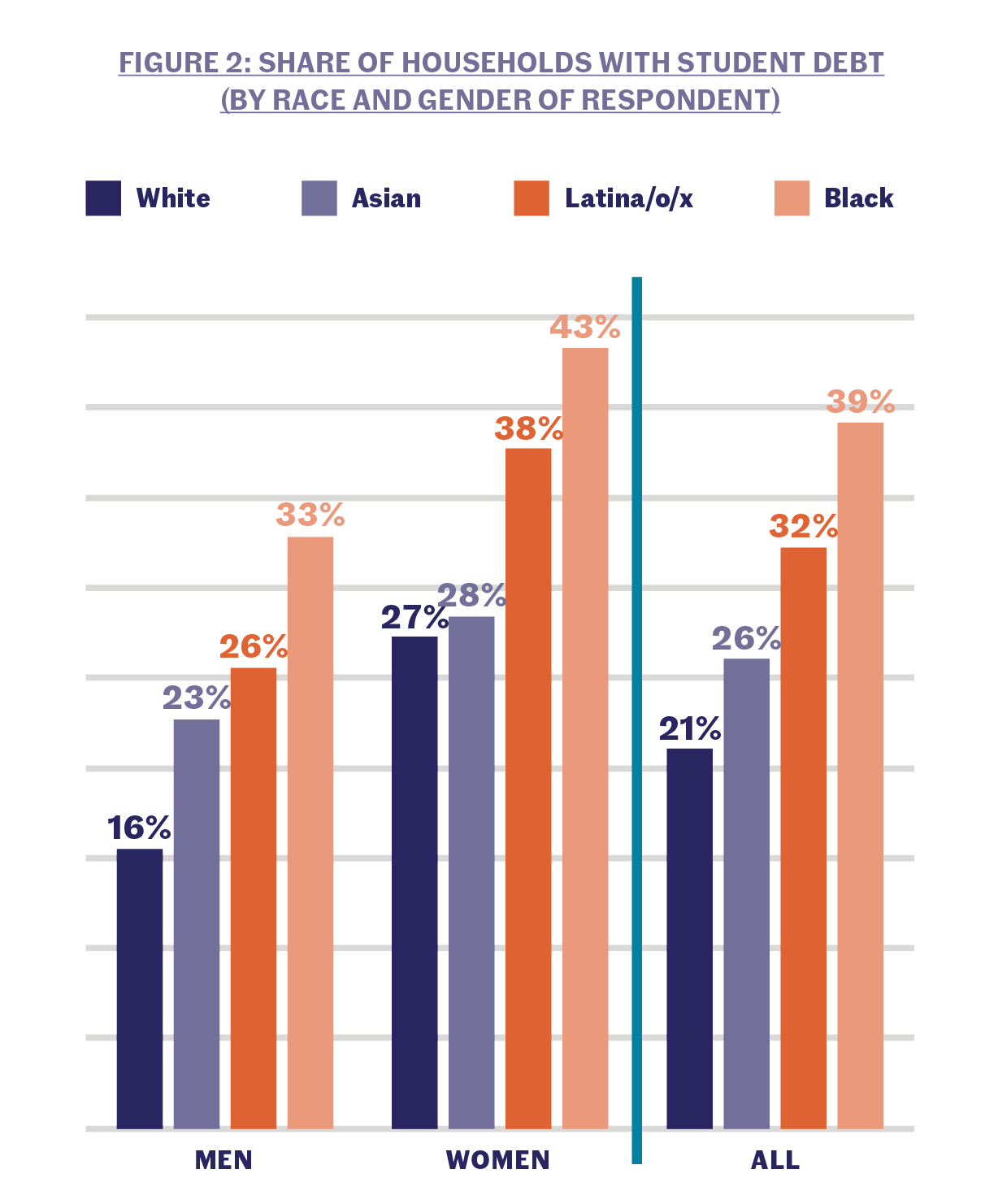

- People of color, notably Black and Latina/x women, are much more likely to shoulder student loan debt. About 43 percent of Black and 38 percent of Latina/x women are saddled with student debt and a third of Black men reported the same.

- Borrowers with low incomes, New Yorkers of color, and those without a four-year college degree are more likely to face challenges paying down student debt, including wage garnishment, and to experience increased economic hardship due to their student debt burdens. Among those with student debt, more than a third of low-income New Yorkers and 31 percent of those without a college education said that they or someone in their household defaulted or had delinquent loans.

Introduction

In the past three decades, average tuition and fees at private nonprofit colleges in the U.S. have more than doubled after accounting for inflation. At public four-year colleges, average tuition and fees have risen even faster in inflation-adjusted terms, nearly tripling between 1990-91 and 2020-21.[5] At the same time, the real value of need-based aid to low-income students has failed to keep up with soaring college costs.[6] In 1975, the maximum Pell Grant covered 80 percent of the average cost of college attendance at a public four-year college.[7] By 2016, the value of the maximum Pell Grant had shrunk to less than a third of college costs on average. With significantly reduced student aid, many low-income students attending college are often forced to turn to student loans to fill in the gap.

Student loan debt has reached $1.7 trillion in the United States and is the second largest form of consumer debt next to mortgages. In fact, every 28 seconds a student loan borrower goes into default.[8] In New York State, approximately 2.4 million people owe more than $98 billion in student debt.[9] One million of these borrowers live in New York City. Prior to the COVID-19 related economic downturn, 43 percent of all federal student loans were considered “in distress” because they were either delinquent, in default, or total loan balances were increasing. To support student loan holders during the pandemic, the federal government suspended payments on all U.S. Department of Education-owned student loans in March 2020. When the moratorium on student loans is lifted later this year, this figure will likely increase.[10]

In this brief, part of the series Whose Recovery? Addressing the Needs of Low-Income New Yorkers, we focus on New Yorkers who are disproportionately impacted by student debt and the hardships that they face because of their debt.

Student loan debt is held by New Yorkers at both the top and bottom of the income ladder, as well as across the age spectrum.

In 2021, almost 3 in every 10 New Yorkers we surveyed, across the income spectrum, said that they or a member of their household had student debt. More than a quarter (27 percent) of New Yorkers living in poverty said that they or a member of their household had student debt and even greater shares of moderate- and high-income households also reported having student debt. Furthermore, student loan debt is not just a problem among young adults. The percentage of New Yorkers with student debt aged 45-54 is not dissimilar to those between the ages of 25-34 (36 percent vs 38 percent, respectively). In fact, research from the Government Accountability Office found that the rate of increase in the number of older borrowers and their loan balances have far outpaced their younger counterparts.[11]

This means that increasing numbers of older adults will carry federal student loan debt well into retirement and will likely face severe financial hardship related to that debt.

Now let me read you some types of debt. Of these, please tell me which types of debt you or a member of your household have. Do you or a member of your household have debt from student loans?

People of color are much more likely to shoulder student loan debt, with rates highest among Black and Latina/o/x women.

Over a third (32 percent) of Latina/o/x and an even higher share (39 percent) of Black households reported having student debt, in contrast to just 21 percent of White households. But when taking a closer look at student debt by race and gender, rates are highest among Black and Latina/o/x women: 43 percent of Black and 38 percent of Latina/o/x women have outstanding student loans, compared to just 27 percent of White women. Women owe two-thirds of all outstanding student loan debt, with women of color most likely to shoulder the adverse impacts of this debt.[12] In fact, a report by the American Association of University Women (AAUW) found that Black women repay their student loans at a slower rate compared to their peers and are more likely to struggle with meeting essential expenses because of this debt. There are also stark racial disparities in student loan debt among men: a third of households headed by Black men had student loan debt – double the share of White men (16 percent).

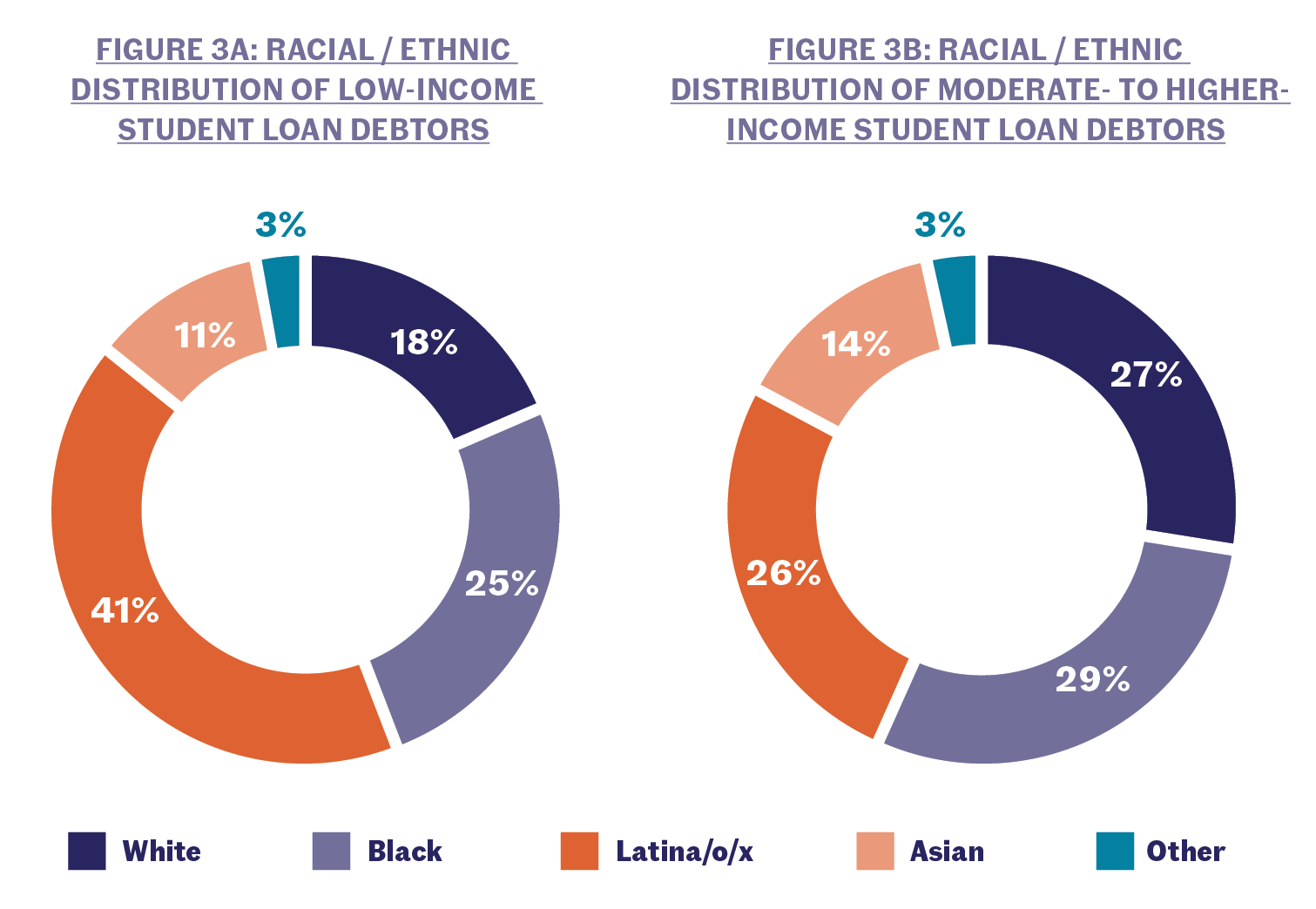

Low-income borrowers are more likely to be Latina/o/x.

Latina/o/x adults make up the largest share (42 percent) of low-income New Yorkers with student debt but represent only 26 percent of moderate to highincome borrowers. The racial/ ethnic composition of moderate to high income student debtors is more evenly distributed, with the Latina/o/x share similar to Black and White shares.

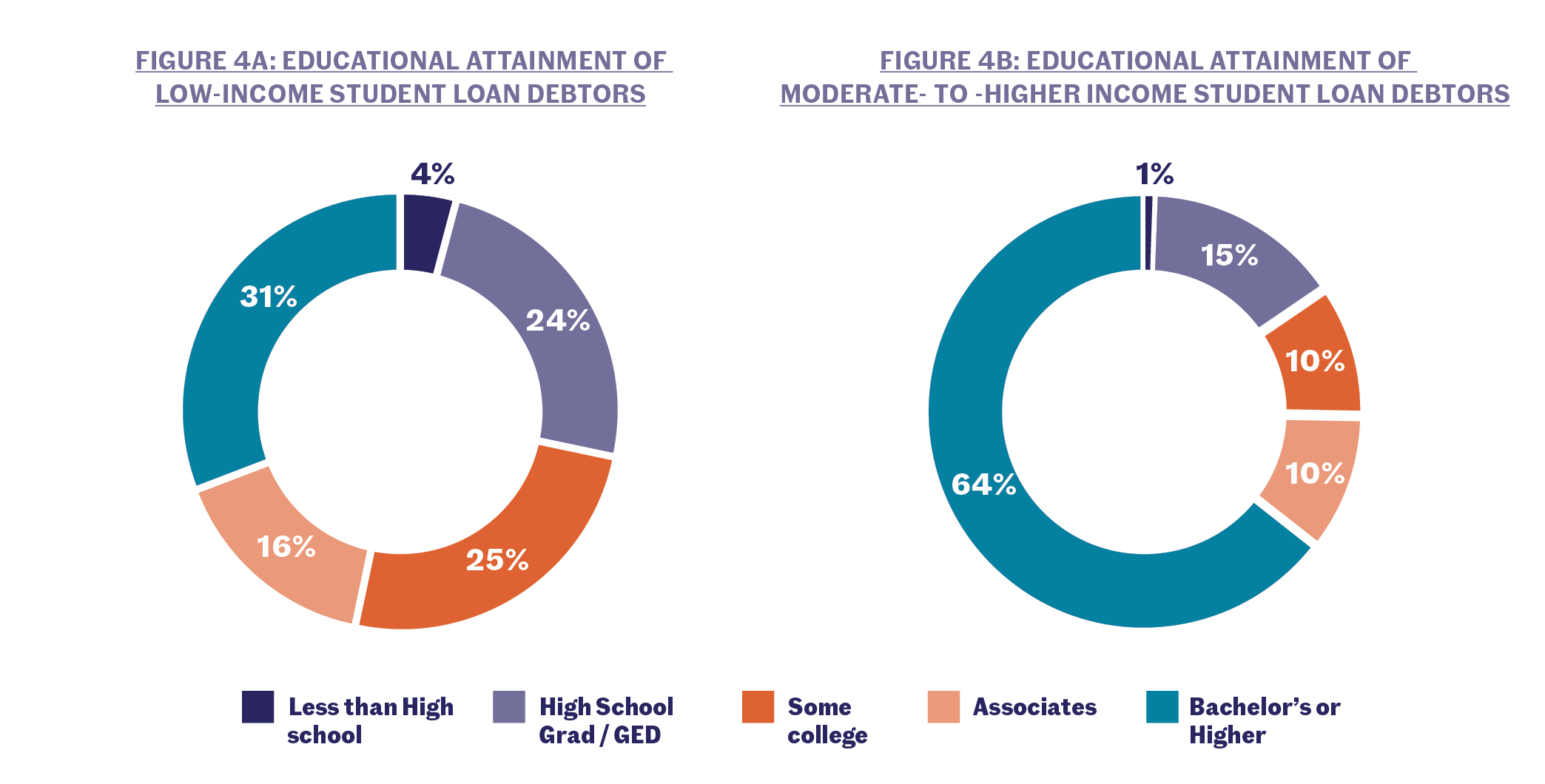

The majority of low-income New Yorkers with student debt do not have a four-year degree.

In fact, adults without a college degree make up two-thirds of low-income New Yorkers with student debt but only 36 percent of those with moderate to high incomes. College graduates account for almost two thirds (64 percent) of moderate to high income borrowers but only 31 percent of low-income borrowers. Higher income households account for a disproportionate share of the total student loan debt, but they are also most likely to have completed their degree, including graduate studies and may have higher earnings potential.[13] This means that they are likely to stay out of default, but this does not mitigate the short- and long-term effects of this debt such as the inability to save for retirement, start a family, or purchase a home. At the same time, other research has found that lower-income households account for about 20 percent of total outstanding student loan debt.[14] They are most likely to be people of color who have not been able to complete their degree. They often struggle to repay lower levels of debt, become delinquent and are unable to pay for necessities, without a college degree and prospects for potentially earning more income with the education credential.

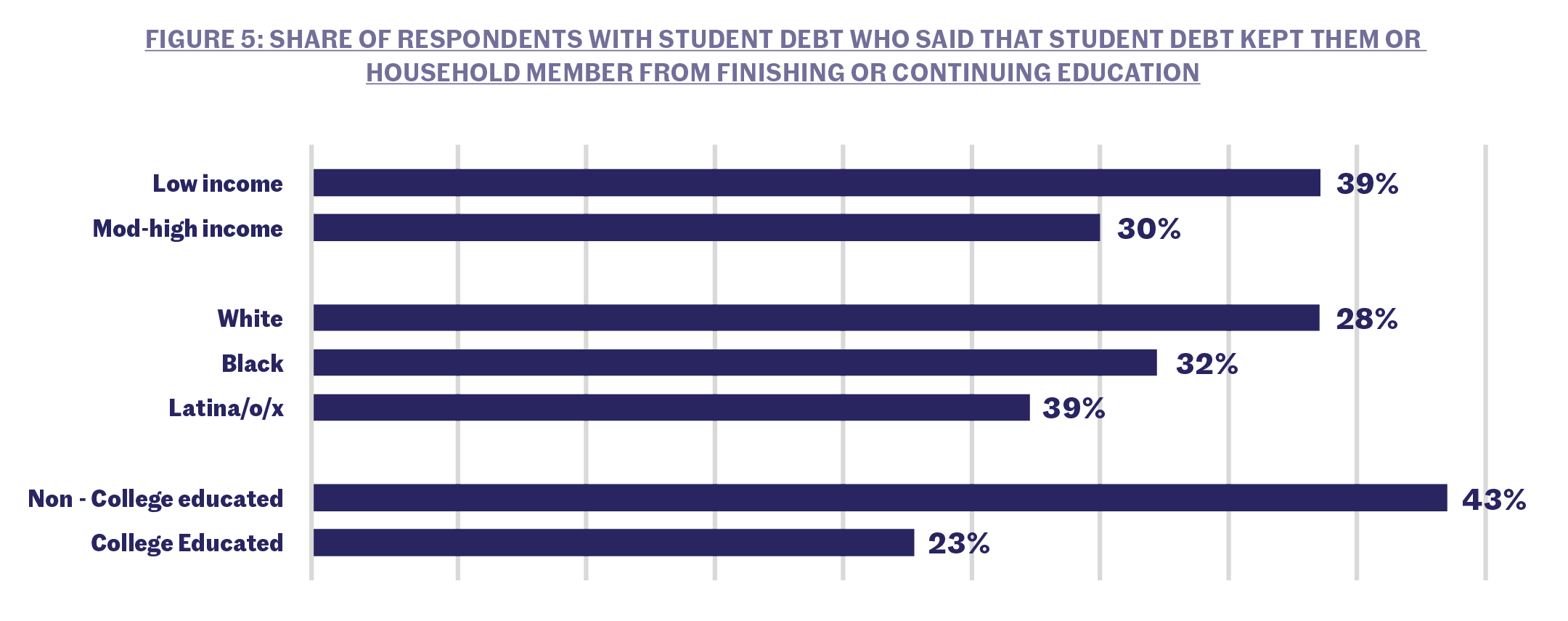

Low-income New Yorkers, Latina/o/x New Yorkers, and those without a four-year college degree are more likely to report that student debt was a barrier to finishing or continuing their education in the last few years.

Around 4 out of every 10 low-income New Yorkers with student debt said that they or someone in their household was unable to finish or continue their education in the last few years, compared to 30 percent of those with moderate to high incomes. A similar share of Latina/o/x New Yorkers (39 percent) with student debt made the same claim compared to 28 percent of White New Yorkers. An even higher share—43 percent—of student debtor households headed by an adult without a college degree said that they or someone in their household had to put off completing or continuing their education.

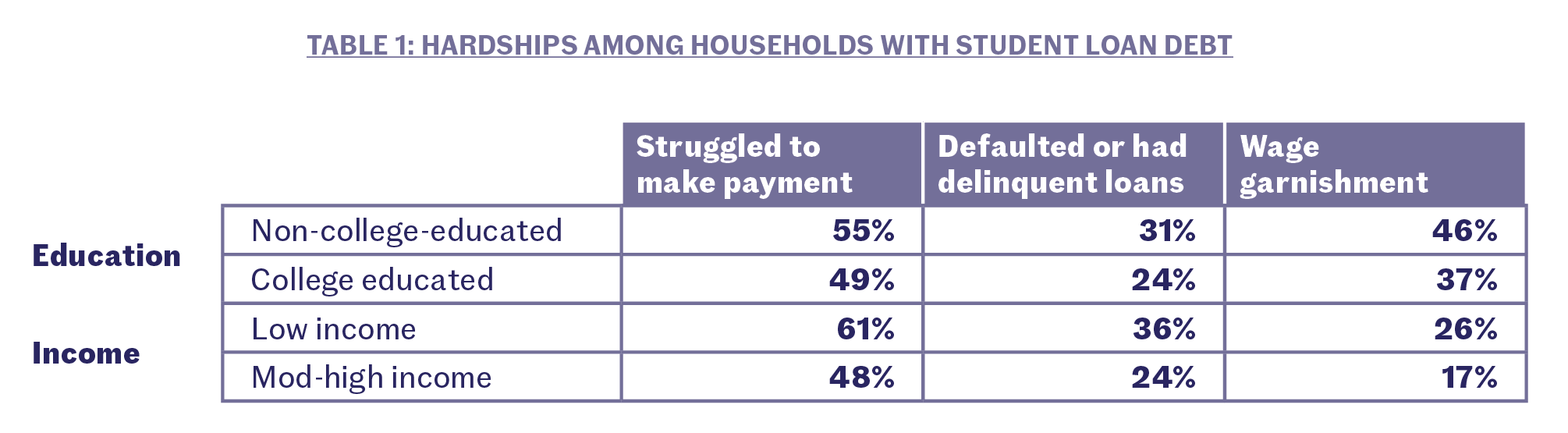

Borrowers with low incomes and those without a four-year college degree are more likely to face challenges paying down student debt and experience loan delinquency or default.

Among those with student debt, an alarming 61 percent of low-income New Yorkers said that they or someone in their household struggled to make a payment in the last few years, compared to 48 percent of those with moderate to high incomes. With the majority of low-income New Yorkers facing challenges staying on top of their student loan payments, more than a third (36 percent) reported that they or someone in their household experienced loan delinquency or default in the last few years, compared to 24 percent of those with moderate to high incomes. Low-income borrowers of color were especially vulnerable to loan delinquency or default—35 percent of Latina/o/x borrowers and half (47 percent) of Black borrowers had defaulted or were delinquent on their loan payments, compared to 24 percent of White borrowers. Non-college educated New Yorkers are also more likely than those with a four-year college degree to struggle with their student loan payments: 31 percent of indebted respondents without a 4-year degree reported that they or someone in their household had defaulted on their student loans or were delinquent in their payments over the past few years, compared to less than a quarter of those with a college degree. The economic impacts of falling behind on student loan payments can be devastating, with more than a quarter (26 percent) of low-income New Yorkers saying that they or someone in their household had their wages, tax refund or social security payments garnished, in contrast to 17 percent of those with moderate to high incomes.

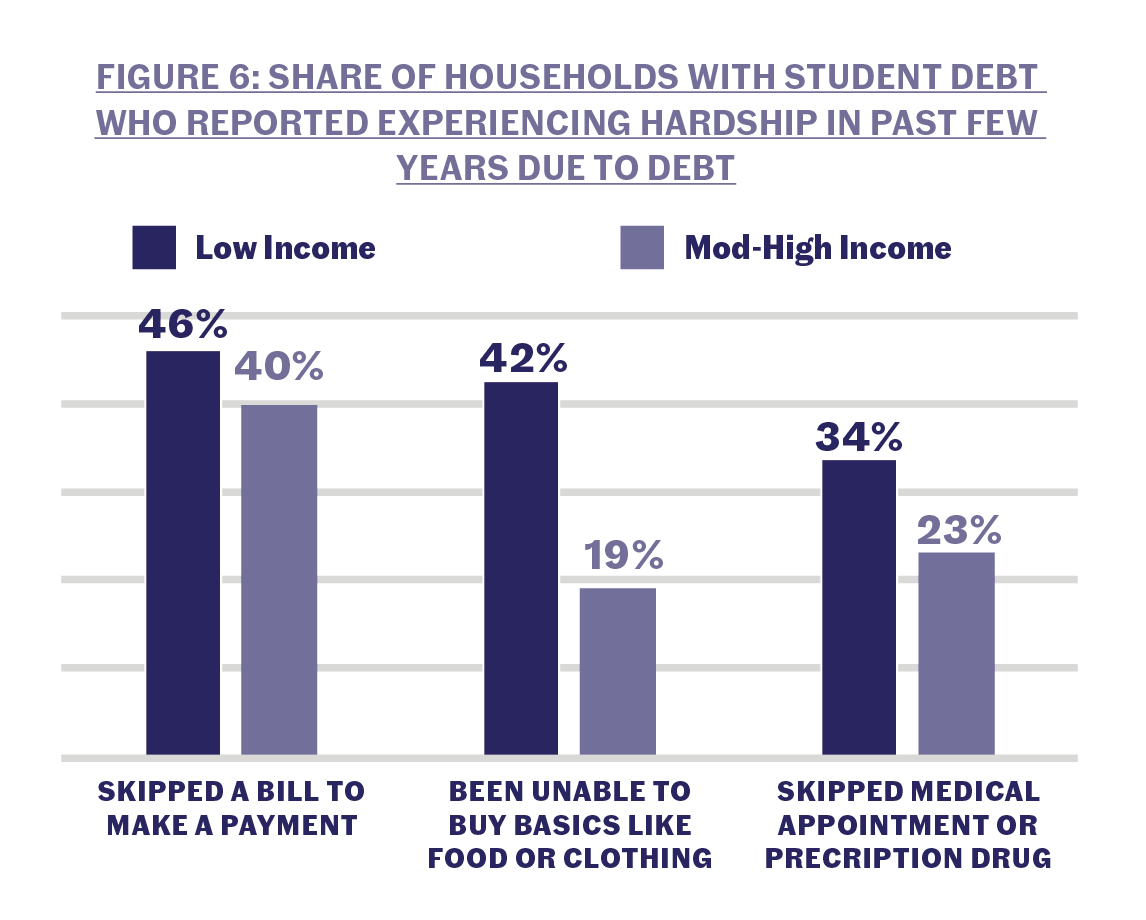

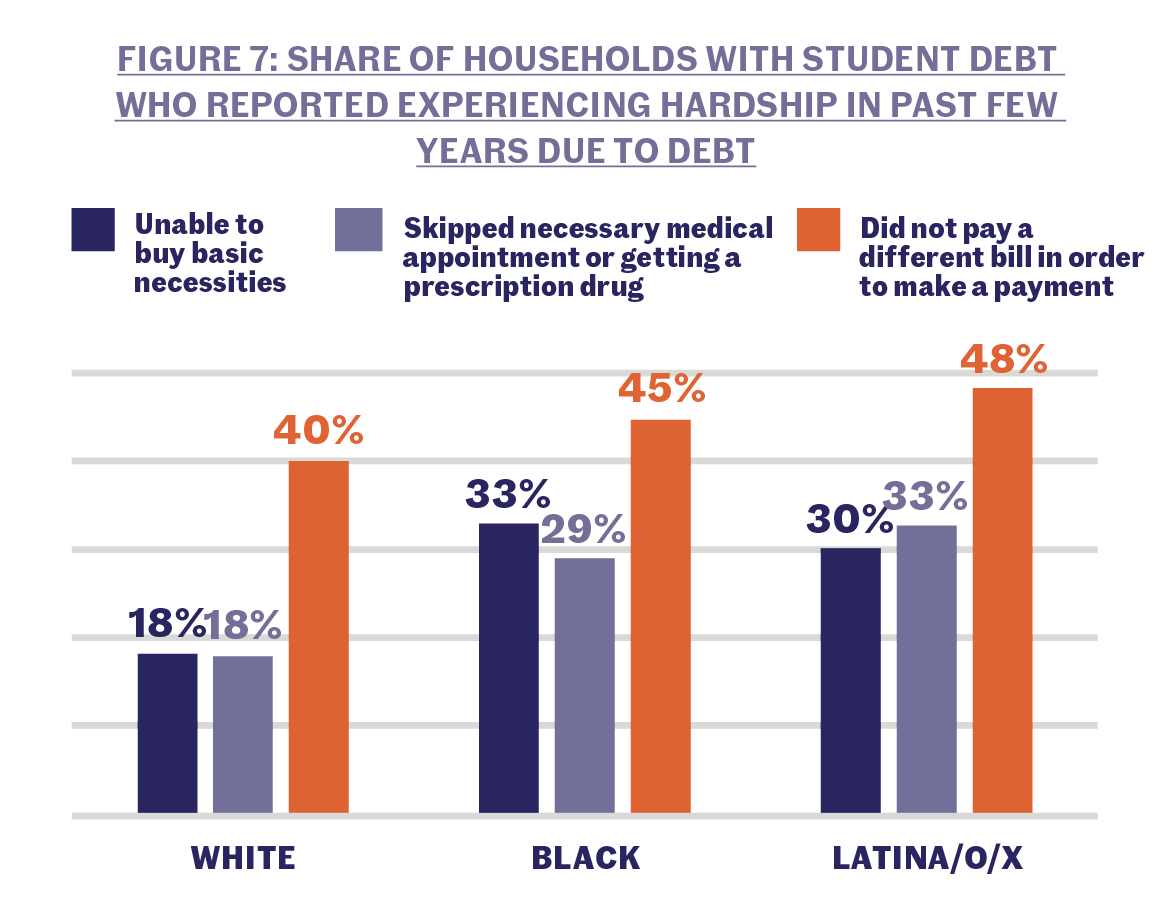

Low-income borrowers, those without a college degree and New Yorkers of color, are more likely to experience increased economic hardship and difficulties with meeting their basic needs.

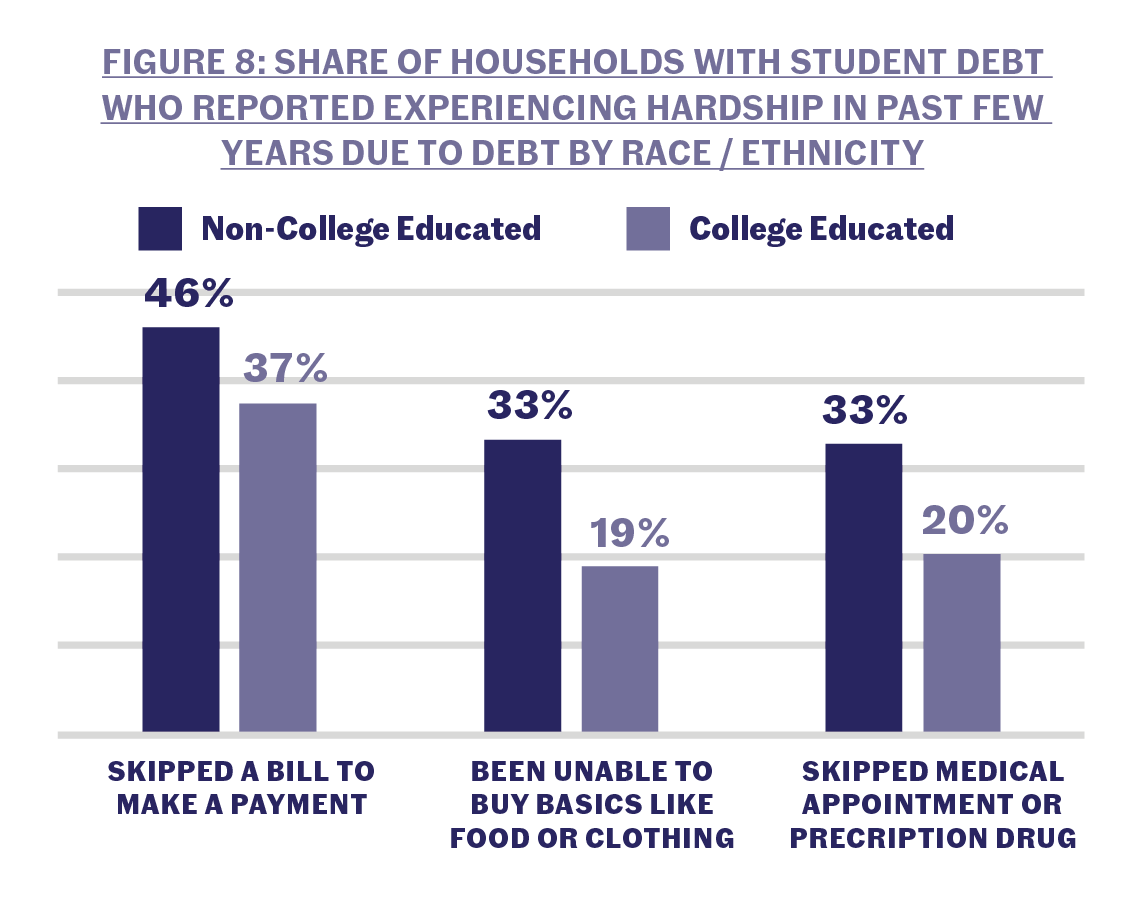

Compared to their higher income counterparts, low-income borrowers face higher rates of economic hardship and are forced to make difficult spending tradeoffs due to their student debt burdens. Nearly half (46 percent) of lowincome New Yorkers with student debt said that they or a member of their household left other bills unpaid so that they could make their student loan payments in the past few years. Low-income New Yorkers are also twice as likely as those with moderate to high incomes to struggle to afford necessities, like food or clothing, because of their student debt (42 percent vs. 19 percent, respectively). Borrowers of color are especially vulnerable to economic hardship, with a third of Black New Yorkers and 30 percent of Latina/o/x New Yorkers who said that that this debt kept them or a member of their household from affording necessities in the last few years, compared to just 18 percent of White New Yorkers. Non-college-educated New Yorkers were also more likely to experience economic instability due to their debt: a third of indebted respondents without a 4-year degree reported that they had been unable to buy necessities in contrast to 19 percent of college graduates.

Conclusion and recommendations

Higher education debt is impacting households across age, incomes, and racial/ethnic groups. Yet, college non-completers, lower income, Black and Latina/o/x households are withstanding the worst of student debt burdens. These borrowers may view student loans as a necessary pathway to higher education and financial security, but the hardships they face due to their debt exacerbate the current wealth gap and promote generational poverty. This means that individuals who have attempted to attain a higher education are often left worse off than if they had never tried in the first place. Based on our Unheard Third findings, here are our policy recommendations for alleviating student debt burdens among New Yorkers at the state and federal levels.

- Make public college more affordable for low- and moderate-income students by expanding eligibility for New York State’s Tuition Assistance Program (TAP) and providing state-funded grant aid for non-tuition-related expenses: Common sense reinvestment in higher education is key to ensuring students are not saddled with student loan debt upon graduation and beyond. Financial aid through New York State’s Tuition Assistance Program (TAP) program helps make the City University of New York (CUNY) and the State University of New York (SUNY) more affordable for low-income students. However, many parttime students are shut out of TAP because the program currently requires students to attend school full-time for at least a year and earn a minimum of 24 credits in the previous year before receiving part-time TAP. We support Governor Hochul’s recent proposal in her Executive Budget to provide $150 million in funding to expand TAP by eliminating the 24-credit eligibility requirement for part-time students. The State should also consider creating a state-funded grant aid program that is modeled after the CUNY ASAP program, which provides coverage of non-tuition expenses for low-income students in CUNY associate degree programs. CSS’s previous research has found that the state’s TAP and Excelsior Scholarship[15] programs fail to adequately address nontuition expenses such as housing, textbooks, transportation,[16] and other fees, which typically account for as much as 60 percent of a college student’s budget, and impact low-income students’ ability to attend higher education.[17]

- Pass The New Deal for CUNY (S.4461-A/A.5843-A): In addition to improving CUNY’s teacher to student ratio and mental health support, the New Deal for CUNY eliminates the cost of tuition for in-state students. The New Deal for CUNY is an investment in the people that invest in New York State. In 2019, CUNY graduates paid an estimated $4.2 billion in state taxes and should be supported as the important tax-base that they represent. Additionally, the City University of New York promotes social mobility by providing academic and professional advancement to students who belong to historically underserved groups – 50% of students comes from a household with incomes below $30,000, 64% of students are persons of color, and 64% of CUNY students are women.[18] From 1847 to 1975, the City University of New York was free to New Yorkers when it served a student body that was primarily White. The New Deal for CUNY would return CUNY to this previous policy, providing a debt-free education to New Yorkers across the racial and gender spectrums.[19]

- Fund student Loan Consumer Assistance Programs (CAPs): Students and families are in distress and need personalized counseling. Borrowers need help formulating strategies and understanding how to take advantage of all options available to them to achieve their goals. It has become abundantly clear that loan servicers alone cannot meet these needs. Non-profit, unbiased assistance remains the best solution. Community Service Society of New York (CSS) created the Education Debt Consumer Assistance Program (EDCAP) in 2019 to help student loan borrowers in New York City and across New York State effectively manage their debt and improve their financial health by providing free, unbiased, one-on-one consumer assistance. EDCAP helps borrowers with both federal and private student debt. Since its inception, it has helped hundreds of borrowers save over $2 million and managed over $38 million in student loan debt. This program provides consumers with an in-depth assessment of their financial situation while accounting for personal objectives and helps them develop feasible short- and long-term solutions related to their student debt. EDCAP becomes a one-stop-shop for student and other debt issues.

The federal and state government should establish and fund consumer assistance programs, like EDCAP, to help struggling borrowers, increase student loan servicer oversight, and inform policy decision making at both the state and federal level. In addition to ensuring that borrowers in New York City are aware of programs like EDCAP, the city should also ensure that borrowers know about federal repayment and forgiveness programs and have the necessary information to take advantage of them. Encouragingly, the city council recently passed a bill requiring the Department of Citywide Administrative Services to notify employees and job applicants regarding the availability of federal and state student loan forgiveness programs.

Helping borrowers navigate this immensely complex system will not only save money for those who have student loan debt but will allow millions of dollars to flow back into the economy creating higher levels of home ownership, an increase in small business activity and other financial benefits that will positively impact taxpayers overall.

- Align student loan bankruptcy rules with those for regular consumer debt: Discharging student loans through bankruptcy is extremely difficult under the current rules. It requires showing “undue hardship” and initiating an adverse proceeding, but student loan debt is not distinctly different from consumer debt in terms of the financial and economic hardship that borrowers experience. Congress should enact legislation to amend the U.S. Bankruptcy code to allow student loans to be discharged in bankruptcy without the need to prove undue hardship. Bankruptcy, of course, is a last resort measure, but can allow those struggling to repay, at times for decades, to get the fresh start they desperately need.

- Reform current federal loan programs to assist those most in need:

- Reforming repayment plans to account for cost of living. There are various repayment plan options that in theory should be affordable, but for many borrowers in high cost-of-living states, like New York, they are not. More borrowers are struggling to find a repayment plan they can afford and maintain long term and are thus at the brink of delinquency and default. Reforming the current Income Driven Repayment formula to reduce the percentage of discretionary income is vital.

- Social Security should be exempt from offset to pay off defaulted student loans. An increasing number of borrowers are entering retirement with student loan debt. Many of them rely solely on their Social Security retirement benefits to survive. The government is allowed to offset fifteen percent of their benefit to pay defaulted student loans, leaving many older adults without the resources needed for necessities like food and clothing. Government benefits are exempt from collection when it comes to most kinds of consumer debt. This protection should be extended to Social Security payments and other income of low-wage earners for student loan debt as well.

- Auto-enrollment and auto-renewal in Income Driven Repayment Plans: Upon graduation, borrowers are placed in a standard repayment plan which many cannot afford. This can lead to delinquency and to default. Changing the default repayment plan from Standard to IncomeDriven with annual auto-renewal in the IDR plans (using tax-data matching) would help alleviate this problem.

- Reforming Income-Driven Forgiveness and making the forgiven amount tax-exempt is vital. The current federal student loan rules allow an individual to have their debt forgiven after 20-25 years of repayment in an Income Driven Repayment Plan. This program does not have an employment requirement. However, if Congress is committed to truly offering relief to these borrowers and not having them spend their entire working life in repayment, they should reform IDR and grant forgiveness gradually in proportion to the length of time the borrower has been enrolled in an IDR plan. For example, a borrower enrolled in an IDR plan with a forgiveness period of twenty years could have 10 percent of their loan balance forgiven every two years. In addition, many borrowers are not aware that IDR forgiveness is available and instead resort to deferment and forbearance when struggling to repay their loans. This delays the ability to achieve the forgiveness built into the plans, in many cases for years at a time. There are also concerns about servicers’ ability to properly account for these payments. The existence of the IDR Forgiveness program should be more heavily promoted by servicers. Clear rules for attaining IDR Forgiveness should be given more prominence on the Federal Student Aid website and a tracking tool, similar to the tool offered by FedLoan for PSLF (Public Service Loan Forgiveness) payments, should be available on all servicer sites so that borrowers can follow their progress. Congress should also ensure forgiven amounts are not taxable.

- Reforming repayment plans to account for cost of living. There are various repayment plan options that in theory should be affordable, but for many borrowers in high cost-of-living states, like New York, they are not. More borrowers are struggling to find a repayment plan they can afford and maintain long term and are thus at the brink of delinquency and default. Reforming the current Income Driven Repayment formula to reduce the percentage of discretionary income is vital.

Survey Methodology

The Community Service Society of New York designed this survey in collaboration with Lake Research Partners, who administered the survey by phone using professional interviewers. The survey was conducted from July 8th through August 10th, 2021. The survey reached a total of 1,763 New York City residents, age 18 or older, divided into two samples. 1,110 low-income residents (up to 200% of federal poverty standards, or FPL) comprise the first sample including 533 poor respondents, from HH earning at or below 100% FPL (69.4% conducted by cell phone) and 577 near-poor respondents, from HH earning 101% - 200% FPL (71.1% conducted by cell phone). 653 moderate- and higher- income residents (above 200% FPL) comprise the second sample, including 389 moderate-income respondents, from HH earning 201% - 400% FPL (70.2% conducted by cell phone) and 264 higher-income respondents, from HH earning above 400% FPL (61.7% conducted by cell phone).

Landline telephone numbers for the low-income sample were drawn using random digit dial (RDD) among exchanges in census tracts with an average annual income of no more than $44,660. Telephone numbers for the higher-income sample were drawn using RDD in exchanges in the remaining census tracts. The data were weighted slightly by income level, gender, region, age, immigrant status, and race in order to ensure that it accurately reflects the demographic configuration of these populations. Interviews were conducted in English (1,662), Spanish (83), and Chinese (18). The low-income sample was weighted down into the total to make an effective sample of 600 New Yorkers.

In interpreting survey results, all sample surveys are subject to possible sampling error; that is, the results of a survey may differ from those which would be obtained if the entire population were interviewed. The size of the sampling error depends on both the total number of respondents in the survey and the percentage distribution of responses to a particular question. The margin of error for the entire survey is +/- 2.3%, for the low-income component is +/- 2.9%, and for the higher-income component is +/- 3.8%, all at the 95% confidence interval.

For questions related to the survey, please reach out to Emerita Torres, Vice President of Policy Research and Advocacy, at etorres@cssny.org

Notes

1. Hanson, Melanie. “Student Loan Debt vs Other Debts” EducationData.org, October 12, 2021, https:// educationdata.org/student-loan-debt-vs-other-debts

2. Prepared Remarks by U.S. Secretary of Education Betsy DeVos to Federal Student Aid’s Training Conference. Novermber 27, 2018. https://web.archive.org/ web/20201021183935/https://www.ed.gov/news/speeches/ prepared-remarks-us-secretary-education-betsy-devosfederal-student-aids-training-conference

3. Bill A.5843-A (S.4461-A in the NYS Senate) would enact The New Deal for CUNY. The full text of the legislation is found here: https://www.nysenate.gov/legislation/bills/2021/ A5843

4. EDCAP is a program of the Community Service Society of New York (CSS) that is funded by the New York State Legislature. It was created to help New Yorkers struggling with student debt navigate the student loan repayment system and regain financial health.

5. https://research.collegeboard.org/pdf/trends-collegepricing-student-aid-2020.pdf

6. iv https://www1.nyc.gov/assets/dca/downloads/pdf/ partners/SLD-lowincome_report.pdf

7. https://www1.nyc.gov/assets/dca/downloads/pdf/partners/ SLD-lowincome_report.pdf

8. Student Borrower Protection Center (2018), States for Student Borrower Protection FAQs, available at https:// protectborrowers.org/wp-content/uploads/2018/12/SLSFaqs_12.2018.pdf.

9. Student Borrower Protection Center (2020), New York Student Debt by the Numbers, available at https:// protectborrowers.org/wp-content/uploads/2020/05/NY2020.pdf.

10. U.S. Department of Education, Biden-Harris Administration Extends Student Loan Pause Through May 1, 2022, available at https://www.ed.gov/news/press-releases/biden-harrisadministration-extends-student-loan-pause-throughmay-1-2022.

11. United States Government Accountability Office, “Report to Congressional Requesters: Social Security Offsets – Improvements to Program Design Could Better Assist Older Student Loan Borrowers with Obtaining Permitted Relief,” December 2016.

12. American Association of University Women: Women’s Student Debt Crisis in the United States (May 2017), available at https://www.aauw.org/resources/research/ deeper-in-debt/.

13. Sandy Baum and Adam Looney (Oct. 2020), Who owes the most in student loans: New data from the Fed, available at https://www.brookings.edu/blog/up-front/2020/10/09/whoowes-the-most-in-student-loans-new-data-from-the-fed/

14. Id.

15. In April 2017, former Governor Cuomo and the state legislature approved the creation of the Excelsior Scholarship program to cover four years of public college tuition for students from families earning less than $125,000 a year. However, this program has been criticized for failing to reach an adequate number of low-income students and for failing to cover non-tuition expenses such as student fees, housing and other living expenses. See: Hilliard, Tom. Center for an Urban Future. “Excelsior Scholarship Serving Very Few New York Students.” https:// nycfuture.org/research/excelsior-scholarship and Waters, Michael. Vox.“Why New York’s free college program is still costing its students.” https://www.vox.com/thehighlight/2020/2/5/21113890/new-york-free-collegeexcelsior-tuition. February 13, 2020.

16. The cost of a Metrocard was cited as the most common nontuition-related barrier among low-income students surveyed by the Center for an Urban Future. See: Center for an Urban Future, “Opportunity Costs.” https://nycfuture.org/pdf/CUF_ OpportunityCosts_Final.pdf. Research conducted by the Community Service Society has also found that low-income students struggle with transit affordability. See Stolper, Harold and Nancy Rankin. Community Service Society. “The Transit Affordability Crisis: How Reduced MTA Fares Can Help Low-Income New Yorkers Move Ahead.” https://www. cssny.org/publications/entry/the-transit-affordabilitycrisis. April 2016.

17. Treschan, Lazar, Irene Lew, Harold Stolper and Nancy Rankin. Community Service Society. “Making College More Affordable For New Yorkers Who Need the Most Support A Proposal to Fund Non-Tuition Expenses for Low- and Middle-Income College Students.” https://smhttp-ssl-58547. nexcesscdn.net/nycss/images/uploads/pubs/CSS_College_ Affordability_Proposal_3_21_17_Final1.pdf. March 2017.

18. “CUNY’s Contribution to the Economy.” March 21, 2021. Office of the Comptroller of the City of New York. https:// comptroller.nyc.gov/reports/cunys-contribution-to-theeconomy/#sources-notes

19. New Deal for CUNY Concept Paper.” January 2022. CUNY Rising Alliance. https://cunyrisingalliance.org/nd4cconcept-paper