Many New Yorkers Are Still Not Aware of Their Right to Paid Sick Time

Irene LewEmerita Torres

Context:

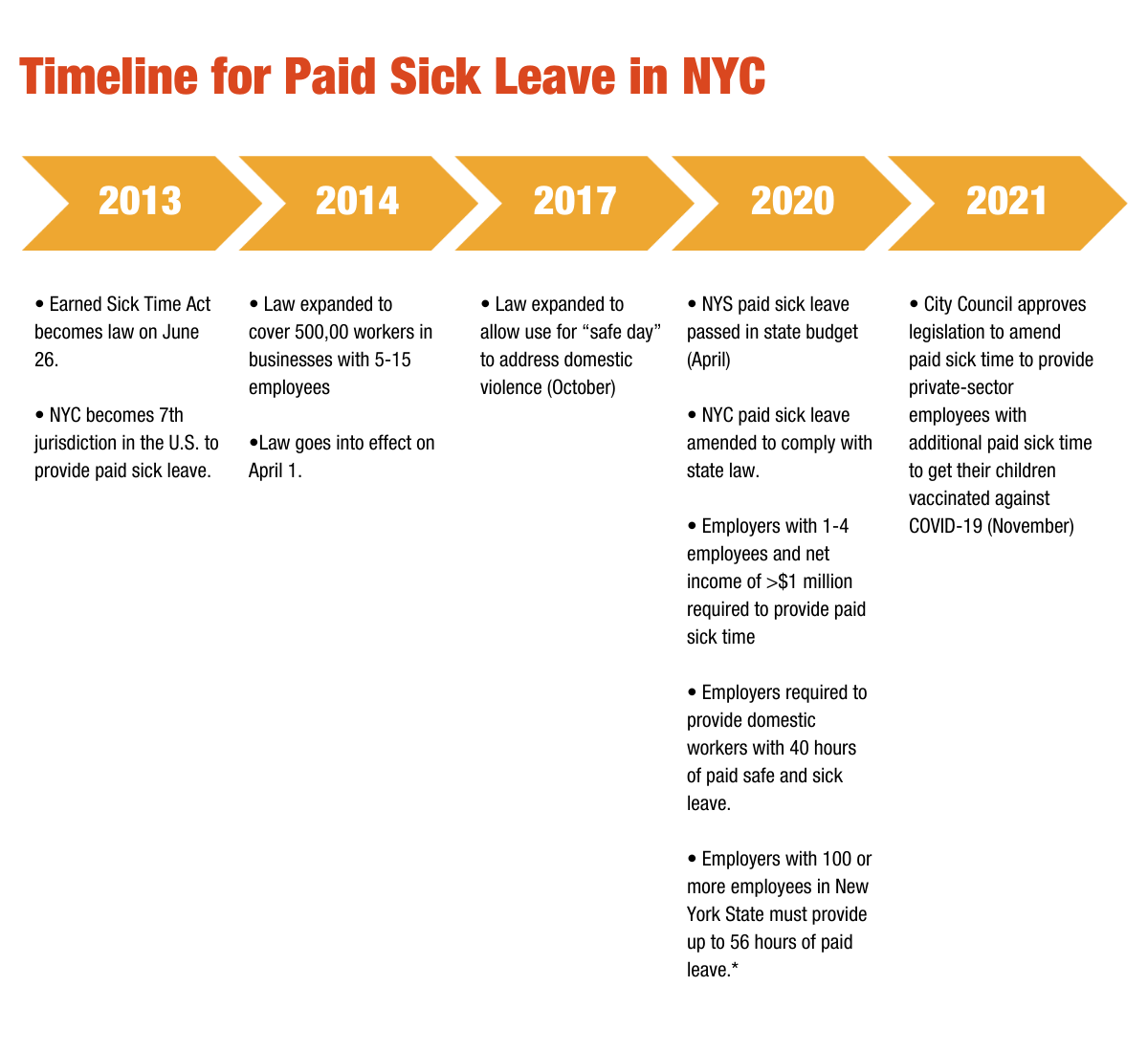

Following a four-year campaign led by the Community Service Society and a broad coalition of workers, labor and advocates, the Earned Sick Time Act became law on June 26, 2013, providing sick leave for the first time to nearly a million workers in New York City who previously lacked this basic labor standard. Mayor Bill de Blasio and the City Council went on to expand the law to provide paid sick leave to an additional 500,000 workers in smaller businesses with 5 to 15 employees. The law went into effect on April 1, 2014. The city’s Department of Consumer and Worker Protection (formerly known as the Department of Consumer Affairs) has ramped up its efforts in recent years—especially during the pandemic—to educate the public and to enforce the law. Yet, seven years after the paid sick leave law took effect, and amid a once in a lifetime global pandemic, many low-income New Yorkers still don’t know about their right to paid sick time, undermining the law’s effectiveness. This brief is part of the series Whose Recovery? Addressing the Needs of Low-Income New Yorkers based on CSS’s 2021 Unheard Third survey of low-income New Yorkers and focuses on paid sick leave awareness and access to paid sick days. With new COVID-19 cases linked to the new highly contagious[1] Omicron variant of COVID-19 surfacing in New York City, raising awareness of the city’s paid sick time law is more important than ever for protecting public health and preventing another surge of COVID-19 infections this winter.

Key Findings

- Half of low-income workers still haven’t heard about the city’s paid sick time law seven years after it took effect in 2014.

- Among low-income workers, immigrants, workers in face-to-face industries and those working part-time are generally unaware of the paid sick leave law.

- Among those covered[2] by the paid sick leave law, the workers least likely to have access to the benefit now are immigrant workers, workers in face-to-face industries, part-time workers and those employed by small businesses.

- Among low-income workers covered under the law, the share reporting that they received paid sick leave climbed dramatically between 2013 and 2017 but this trend has reversed in recent years.

Recommendations

- City Council must pass Intro 1797, which would require the Department of Consumer and Worker Protection to produce posters for voluntary ongoing display at pharmacies and health care locations around the city informing New Yorkers of their right to paid sick leave.

- The Department of Consumer and Worker Protection should prioritize outreach and enforcement for smaller businesses and those in face-to-face industries to ensure that employers are aware of the law and in compliance.

*For full list of new amendments to the city’s paid sick leave law to comply with statewide paid sick leave law passed in 2020, please refer to Department of Consumer and Worker Protection’s website.

Introduction

Following a four-year campaign led by the Community Service Society and a broad coalition of workers, labor and advocates, the Earned Sick Time Act became law on June 26, 2013, providing sick leave for the first time to nearly a million workers in New York City who previously lacked this basic labor standard[3]. Mayor Bill de Blasio and the City Council went on to expand the law to provide paid sick leave to an additional 500,000 workers[4] in smaller businesses with 5 to 15 employees. The law went into effect on April 1, 2014. Since the law’s initial expansion and rollout, it was amended in 2017 to permit usage of leave for dealing with safety issues related to domestic violence and in 2020 to comply with statewide paid sick leave legislation enacted as part of the state budget[5]. Most recently, on November 23, 2021, the City Council approved legislation that would amend the city’s paid sick leave law to provide private-sector employees with additional paid sick time to get their children vaccinated against COVID-19.

Yet, seven years after the paid sick time law took effect, many low-income workers still haven’t heard about their right to paid sick leave, undermining the law’s effectiveness. Lack of awareness of paid leave laws can prevent low-income and other vulnerable workers from reaping the full benefits of these laws. With new COVID-19 cases linked to the new highly contagious Omicron variant of COVID-19 surfacing in New York City, raising awareness of the city’s paid sick time law—and its new amendments—is more important than ever to protect public health and prevent another surge of COVID-19 infections this winter. This brief, part of the series Whose Recovery? Addressing the Needs of Low-Income New Yorkers, is based on CSS’s 2021 Unheard Third survey of low-income New Yorkers. It focuses on paid sick leave awareness among workers and access to paid sick leave, and includes analysis of responses to the following question we have asked since 2014:

How much have you heard about a law in NYC that gives employees five paid sick days: a lot, some, a little or none at all?

Half of low-income workers still haven’t heard about the city’s paid sick time law seven years after it took effect in 2014.

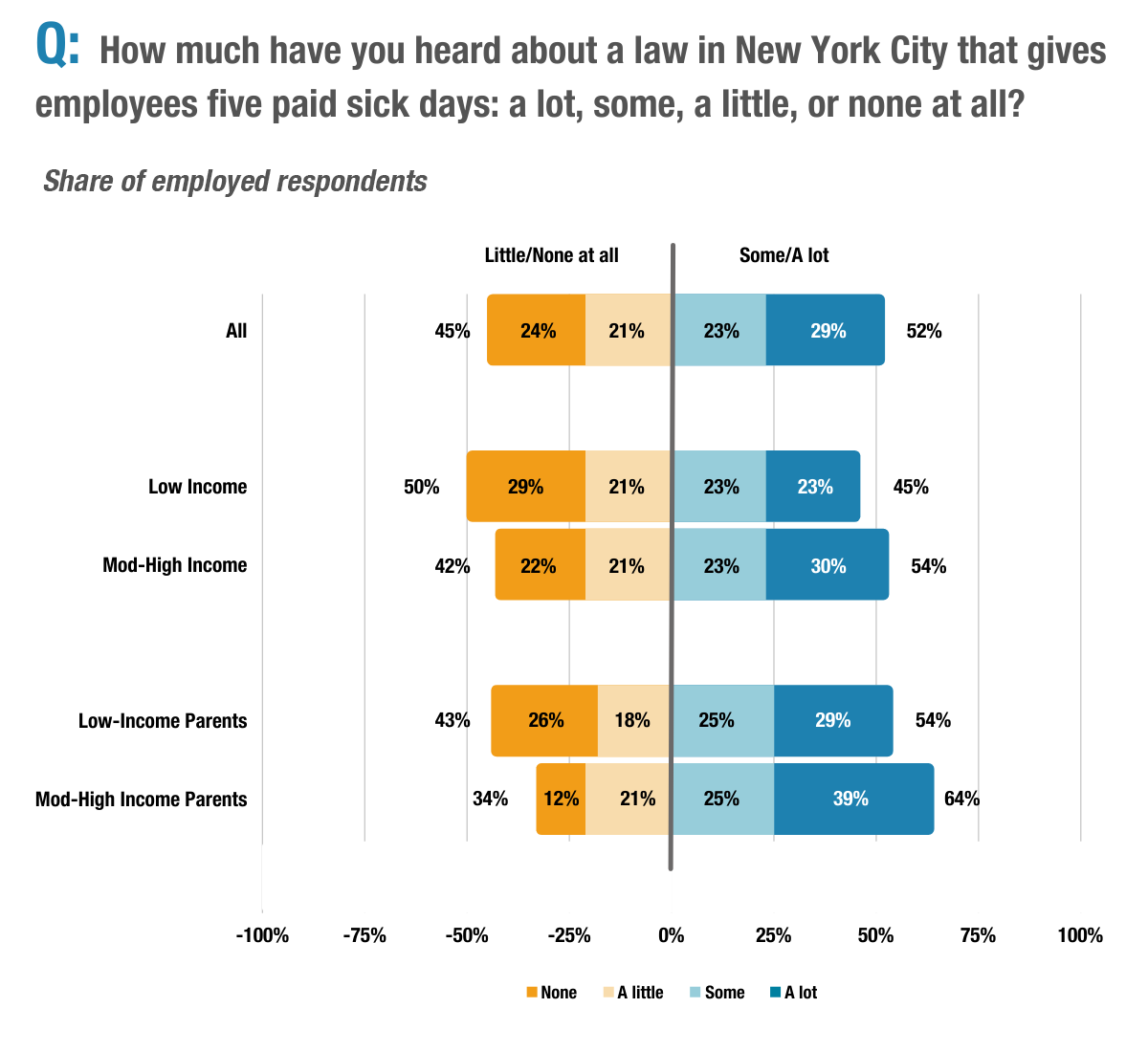

We found that low-income workers were more likely than those with moderate to higher incomes to be unfamiliar with the city’s paid sick time law: 50 percent of low-income vs. 43 percent of moderate- to-higher-income workers haven’t heard about the city’s paid sick leave law. Awareness of the paid sick time law is much higher among working parents than for the overall workforce: 61 percent of working parents have heard about the law compared to 52 percent of all workers. However, low-income parents were still less likely than those with higher incomes to have heard about the law —43 percent of low-income parents have heard little to nothing about the law, compared to 34 percent of moderate to higher income parents who were unfamiliar with the law.

Among low-income workers, immigrants, employees in face-to-face industries[6] and those working part-time are generally unaware of the paid sick leave law.

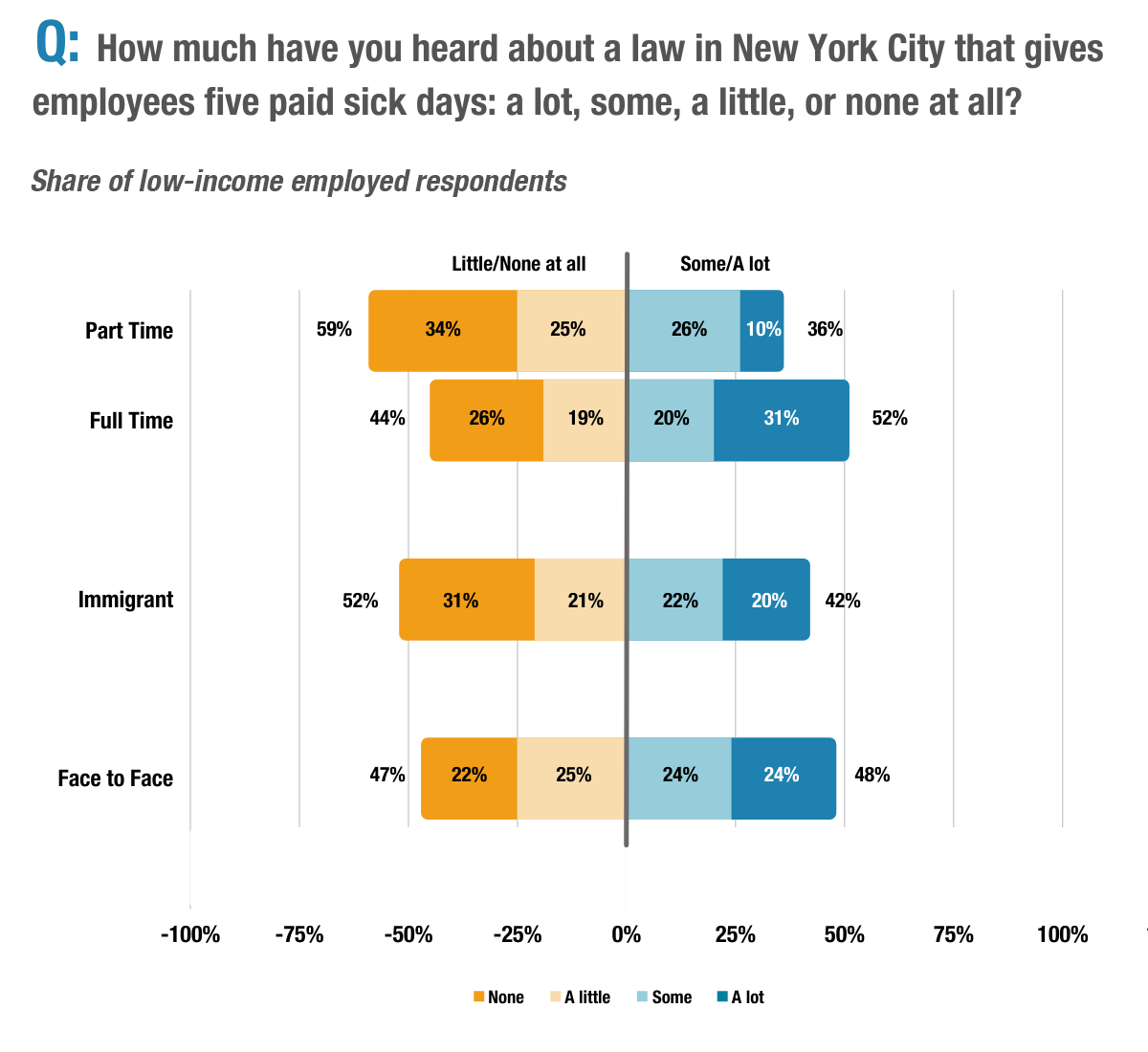

Figure 2 shows that more than half of low-income immigrant workers surveyed are unfamiliar with the law, with 31 percent reporting that they haven’t heard anything at all about it. This is concerning given that undocumented workers are covered under the paid sick time law and have all the same rights and protections regardless of their immigration status. Meanwhile, 47 percent of low-income workers in face-to-face industries such as food service, hotel and construction still haven’t heard about the paid sick time law, although this segment of the workforce is especially vulnerable to contracting COVID-19. Part-time workers are covered under the law but are three times less likely than those working full time to have heard a lot about paid sick days— only 10 percent of part-time workers have heard a lot about the law, in contrast to 31 percent of full-time workers with this level of awareness.

Covered low-income workers least likely to have paid sick leave now are immigrants, workers in face-to-face industries, part-time workers and those employed by small businesses.

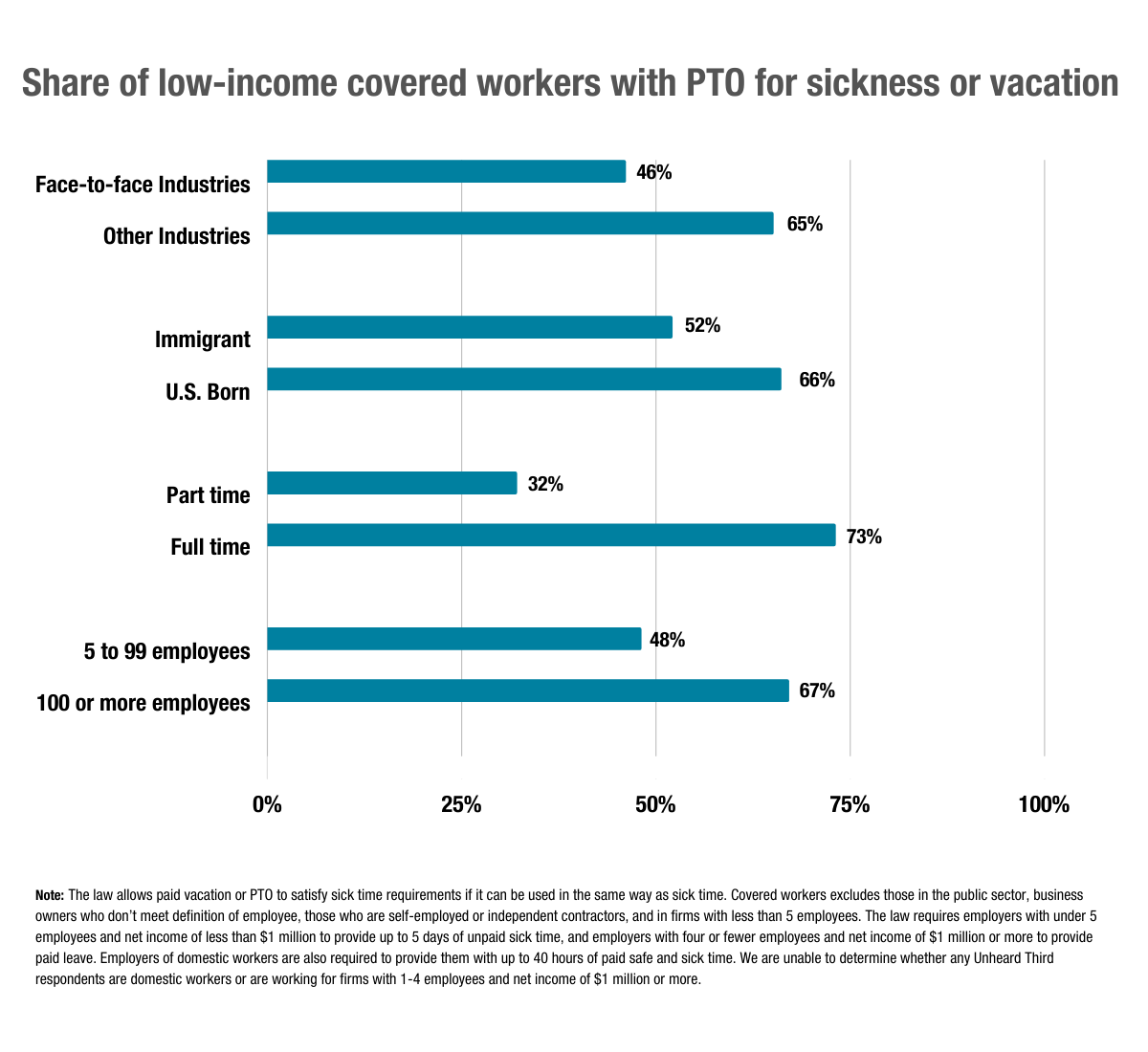

Low awareness of the city’s paid sick leave policy may be preventing the most vulnerable New Yorkers from reaping the full benefits of the law. Figure 3 shows that less than half of eligible (“covered”) workers in face-to-face industries reported receiving paid sick leave from their employer, compared to nearly two-thirds of those with employment in other industries. The gap in access to paid sick leave was especially stark between full-time and part-time workers covered under the law: 73 percent of full-time workers said that they received paid sick leave from their employer, more than double the share of part time workers who reported receiving this benefit.

Among low-income workers covered under the law, the share reporting that they received paid sick leave climbed dramatically between 2013 and 2017 but this trend has reversed in recent years.

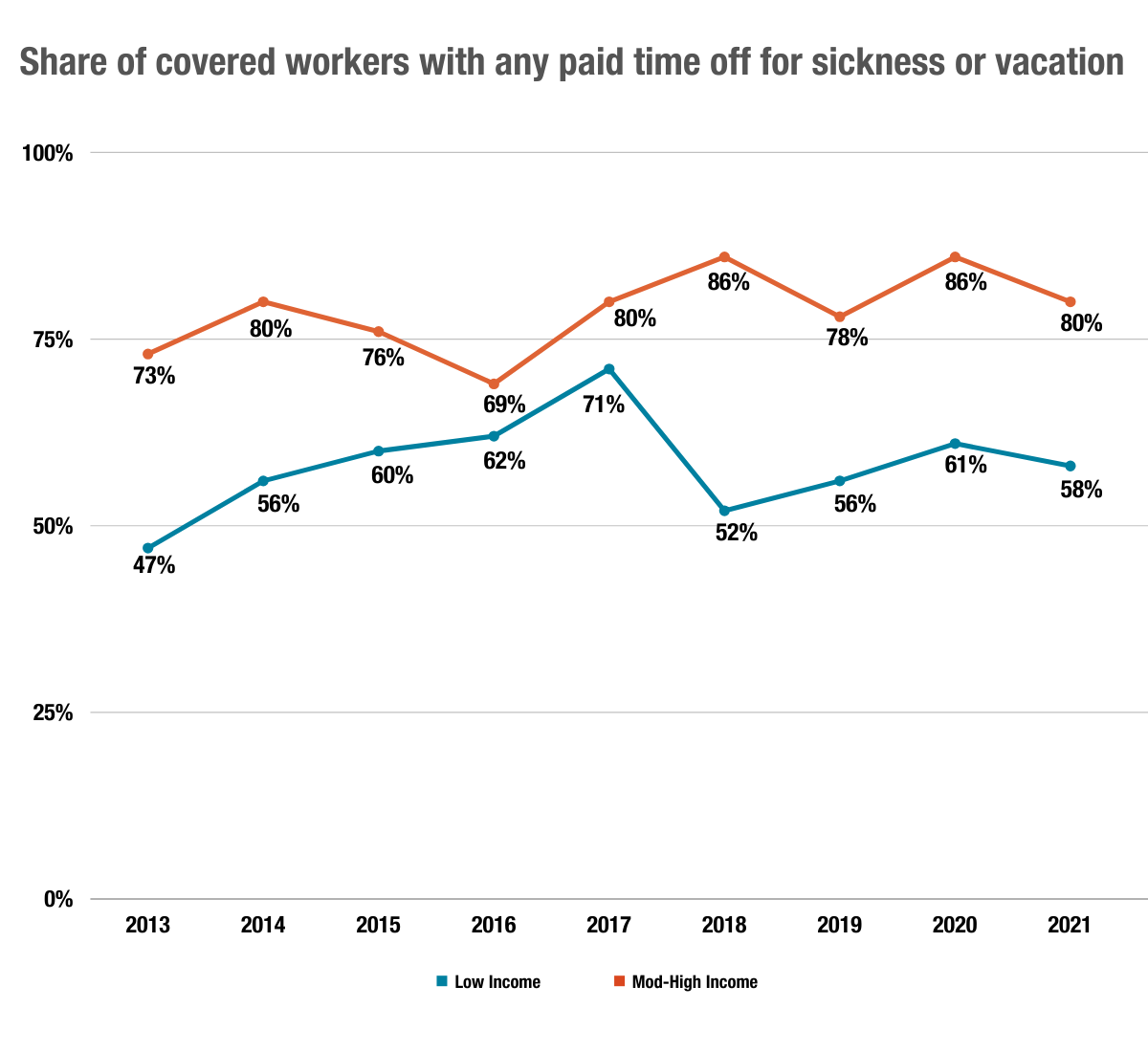

Prior to the expansion and rollout of the paid sick days law, less than half (47 percent) of low-income workers now covered by the law said that they received paid time off for vacation or sickness in 2013. But after the law took effect in 2014, the share of covered low-income workers reporting receipt of paid time off surged to 71 percent in 2017. Extensive public outreach and advertising surrounding the launch of paid sick days, as well as strong enforcement, played a key role in this progress[7]. Yet, the trend has reversed in recent years. Figure 4 shows that since 2017, the share of low-income workers covered under the law who reported that their employers provided them with paid time off for sickness and vacation fell from 71 percent to 58 percent in 2021.

Note: Starting in 2018, the survey included an additional question that asked respondent whether they were self employed/independent contractor or not, which resulted in a smaller sample of private sector employees covered under paid sick time law. Prior to 2018, only those who volunteered a response of “self-employed/business owner” to the question about firm size were excluded.

Conclusion

With cases of the new Omicron variant now popping up in New York, it is imperative that employees covered under the city’s paid sick time law are aware of their right to paid leave and of the recent amendments to the law. Furthermore, lack of awareness can be a major impediment to effective enforcement because enforcement is largely complaint-driven and workers unaware of their rights are much less likely to file a complaint against their employer.

Findings from CSS’s 2021 Unheard Third Survey highlight the need for the City to roll out a widespread public education campaign to inform employees of their rights under the Earned Safe and Sick Time Act. In June 2021, the Department of Consumer and Worker Protection launched a multilingual campaign to spread awareness of the law and of the new amendments that took effect in the aftermath of the passage of statewide paid sick leave. The campaign ran targeted ads on the city’s bus shelters and LinkNYC kiosks, as well as in online and in neighborhood businesses such as doctors’ offices and pharmacies.[8] Although this campaign was a step in the right direction, it is unclear to what extent this has been effective in helping the most vulnerable workers learn about their right to paid sick time.

Recommendations

-

Pass Intro 1797

We urge the City Council to pass Intro 1797, a bill introduced by Councilmember Mark Levine at the request of Manhattan Borough President Gale Brewer. Intro 1797 would require the Department of Consumer and Worker Protection (DCWP) to produce posters for voluntary ongoing display at pharmacies and health care locations around the city informing New Yorkers of their right to paid sick leave. The bill would also invite the NYC Health and Hospitals Corporation to distribute and display these posters at its locations. With New Yorkers continuing to visit health care locations, clinics and NYC Health and Hospitals sites for COVID-19 testing and vaccinations, Intro 1797 would institutionalize a simple, low-cost way to get the word out and target the information to the right people at the right time. Widespread posters would improve awareness among the general public, as well as among employers who may be unaware of their legal obligation to provide paid leave, making it harder for the most vulnerable workers to be denied their rights.

-

Prioritize outreach and enforcement for smaller businesses and those in face-to-face industries to ensure that employers are aware of the law and in compliance.

Many covered workers in smaller businesses with fewer than 100 employees and those in face- to- face industries such as restaurant, food service and hotel, still don’t receive paid sick time although they remain at heightened risk of contracting COVID-19. Employers are required to notify their covered employees of their right to safe and sick leave, as well as provide their employees with their accrued, used, and total leave balances on a document issued each pay period (e.g., paystub) or through an employee-accessible electronic system. However, it is unclear to what extent these employer requirements are enforced and employers are complying with the law. While DWCP has conducted workplace inspections and employer outreach in the past year, it should also target outreach and enforcement efforts for smaller businesses and those in face-to-face industries who are more likely to be noncompliant with the law.

Survey Methodology

The Community Service Society of New York designed this survey in collaboration with Lake ResearchPartners, who administered the survey by phone using professional interviewers. The survey wasconducted from July 8th through August 10th, 2021. The survey reached a total of 1,763 New York Cityresidents, age 18 or older, divided into two samples. 1,110 low-income residents (up to 200% of federalpoverty standards, or FPL) comprise the first sample including 533 poor respondents, from HH earningat or below 100% FPL (69.4% conducted by cell phone) and 577 near-poor respondents, from HHearning 101% - 200% FPL (71.1% conducted by cell phone). 653 moderate- and higher-income residents(above 200% FPL) comprise the second sample, including 389 moderate-income respondents, from HHearning 201% - 400% FPL (70.2% conducted by cell phone) and 264 higher-income respondents, from HHearning above 400% FPL (61.7% conducted by cell phone).

Landline telephone numbers for the low-income sample were drawn using random digit dial (RDD)among exchanges in census tracts with an average annual income of no more than $44,660. Telephonenumbers for the higher-income sample were drawn using RDD in exchanges in the remaining censustracts. The data were weighted slightly by income level, gender, region, age, immigrant status, and racein order to ensure that it accurately reflects the demographic configuration of these populations.Interviews were conducted in English (1,662), Spanish (83), and Chinese (18). The low-income samplewas weighted down into the total to make an effective sample of 600 New Yorkers.

In interpreting survey results, all sample surveys are subject to possible sampling error; that is, theresults of a survey may differ from those which would be obtained if the entire population wereinterviewed. The size of the sampling error depends on both the total number of respondents in thesurvey and the percentage distribution of responses to a particular question. The margin of error for theentire survey is +/- 2.3%, for the low-income component is +/- 2.9%, and for the higher-incomecomponent is +/- 3.8%, all at the 95% confidence interval.

For questions related to the survey, please reach out to Emerita Torres, Vice President of Policy Research and Advocacy, at etorres@cssny.org

Footnotes

[1] Leonhardt, David. “Four Big Questions About Omicron.” December 7, 2021.

[2] Covered workers excludes those in the public sector, business owners who don’t meet definition of employee, those who are self-employed or independent contractors, and in firms with less than 5 employees. Please see FAQs from Department of Consumer and Worker Protection for full list of covered workers.

The law requires employers with under 5 employees and net income of less than $1 million to provide up to 5 days of unpaid sick time, and employers with four or fewer employees and net income of $1 million or more to provide paid leave. Employers of domestic workers are also required to provide them with up to 40 hours of paid safe and sick time. We are unable to determine whether any Unheard Third respondents are domestic workers or are working for firms with 1-4 employees and net income of $1 million or more.

[3] https://www.cssny.org/key-successes/entry/a-victory-on-paid-sick-days

[4] NYC Department of Consumer Affairs. NYC’s Paid Sick Law: First-Year Milestones.

[5] As part of this expansion, small businesses (with four or fewer employees) that have net income of $1 million or more are now required to provide paid leave. In addition, large businesses of 100 or more employees must now provide up to 56 hours of paid sick leave.

[6] Face to face industries include workers who said that they worked in the following industries: hotels, restaurants/food delivery/food service; construction; and arts and entertainment. This is in line with Center for NYC Affairs category of “face to face” industries described here.

[7] NYC Department of Consumer Affairs. “NYC’s Paid Sick Leave Law: First-year Milestones.”

[8] NYC Department of Consumer and Worker Protection.