End Medical Debt

Protecting patients by stopping unfair billing practices

We want to thank Governor Hochul and the legislature for taking significant steps in the 2024-25 budget to #EndMedicalDebt in New York.

Our work is not done! For the remainder of the session, which ends on June 6, the #EndMedicalDebt campaign is calling on the legislature to pass the “Stop SUNY Suing” Act (A8170|S7778), which would prevent the five state-operated hospitals from suing their patients with medical debt.

New York hospitals have filed more than 80,000 lawsuits against New Yorkers since 2015. The five State-run facilities file a disproportionately large share of medical debt lawsuits: 20 percent (16,000) of all lawsuits since 2019. These state-run facilities receive over $530 million annually in federal Disproportionate Share Hospital funding which is supposed to support their uncompensated care costs. State-run hospitals have an excess of state resources to provide financial assistance to eligible patients instead of suing them. CSS research found that SUNY Upstate disproportionately sued patients who live in low-income communities and communities of color – including patients who were incarcerated and demonstrably had no means to pay their bills.

Call your legislators today and ask them to tell leadership to bring a vote to pass the “Stop SUNY Suing” Act (A8170|S7778)!

Not sure what to say? Here’s an example script:

My name is ______ and I am your constituent. New York’s State-run hospitals receive half a billion dollars annually to cover uncompensated care but some of them aggressively sue patients for small outstanding medical debts. Ask leadership to bring a vote to pass the “Stop SUNY Suing” Act (A8170|S7778) which would prevent the five State-operated hospitals from suing their patients with medical debt. [Option to include a personal story about how medical debt, or the fear of going into medical debt, has impacted you or your loved ones.]

I am calling to ask you to stand up to protect New Yorkers from being sued by State-run hospitals for medical debt. Thank you.

We The Patients: Patient Voices

Hear from seven New Yorkers on the need to #EndMedicalDebt in NY. Have a story to share? Drop us a note at .(JavaScript must be enabled to view this email address).

Facility Fee for Long COVID Care – Sam’s Story

As COVID-19 continues its spread across the country, a growing number of New Yorkers are experiencing persistent memory loss, nerve damage and other chronic neurological symptoms of long COVID. While much is unknown about long COVID at this stage, one thing is clear: the illness can be devastating to patients’ health, well-being and finances.

“Financially, COVID has murdered me.” Said Sam, a 51-year-old New Yorker living on Staten Island. After falling severely ill with COVID in March 2020 at an uncle’s funeral, daily tasks that Sam once did with ease – such as working with animals for her job as a Zoo Educator – became increasingly difficult for her to manage. As a result, she struggled to pay bills while seeking medical care for her neuropathy.

While her company’s first insurance provider covered co-pays for long COVID care, Sam was left responsible to cover those costs when her company switched to a different provider that did not. She had just paid the $126 co-pay of her $310 doctor’s visit when, just before the Christmas holiday, she discovered an even bigger bill lurking on her insurance provider’s web portal: $400, of which she was responsible for $277. After calling their billing department, she learned this large addition was a co-pay on a facility fee – a charge for the hospital’s overhead cost that is unfairly levied on patients.

At the time, Sam was working four jobs to pay her bills. She first tried negotiating the fee, assuming it to be an arbitrary cost like so many hospital charges. “I could not believe this was legal.” Sam said. Even though Sam works part-time as a patient insurance Navigator, her attempt at lowering her own cost of care was unsuccessful.

Next, Sam tried applying for financial assistance. Mt. Sinai denied her although she was eligible, saying assistance was only provided for inpatient care and not outpatient. In the end, she settled on a $20/month payment plan to chip away at the $277 she owed on the facility fee – that’s over a year of payments.

As 2021 came to a close, Sam received an email from Mt. Sinai in her inbox: a request for an end-of-year donation. “I was an old lady screaming at the screen. To ask me for money, are you kidding? It was a mind-blowing moment.”

Despite her frustration, Sam made clear that the care she received at Mt. Sinai’s long COVID facility was excellent. “My doctor saved me. I am not complaining about that in any sense.” Still, she worries that she’ll need to start looking elsewhere for care due to cost.

Sam urged others facing a similar situation to contact helplines like Access Health NYC and Community Health Advocates for immediate assistance. As the pandemic continues to impact New Yorkers, she also hopes more support and attention will be given to patients facing long COVID and other chronic conditions.

They Took My Retirement Funds Over a Medical Bill: Ms. Ellis’ Story

Retired from government work since 1997, Ms. Ellis’ greatest joy is spending time with her daughter and granddaughter in their Queens home. When her retirement funds stopped coming in over an unpaid medical bill she never received – for a procedure she didn’t remember having – her family also became her fiercest advocates.

in over an unpaid medical bill she never received – for a procedure she didn’t remember having – her family also became her fiercest advocates.

Following a heart attack in 2015, Ms. Ellis’ blood count became dangerously low. Her granddaughter rushed her to the nearest emergency room for treatment, where she was admitted to Long Island Jewish Hospital, part of the Northwell health system. While inpatient, a physician performed an endoscopy to confirm she was not bleeding internally. Ms. Ellis’ granddaughter remembers a second doctor briefly looking down her grandmother’s throat, but Ms. Ellis did not.

Rather than bill her primary insurance, Medicare – which would have covered the procedure – the doctor billed her secondary, was denied, and sent the bill directly to Ms. Ellis instead. However, she never received it. The bill arrived at the correct building, but listed no apartment number.

Fast-forward several years later, to August 2021. Ms. Ellis was shocked to learn that her retirement funds were garnished from her bank account, an aggressive debt collection move employed by major hospital systems in New York, Northwell in particular. After Ms. Ellis didn’t pay the bill she never received, a default judgement was entered against her. Even though garnishing federal benefits is prohibited under federal law, the collection attorney did it anyway.

Luckily, Ms. Ellis’ quick-witted granddaughter who works for a court in Brooklyn, was on the case. “It’s a blessing to have my granddaughter.” Said Ms. Ellis. “Once she got involved, I knew she was going to find out what was going on.”

She researched the attorney who had arranged for her retirement to be garnished, finding a string of other devious practices to collect on unpaid medical bills from patients. According to Ms. Ellis’ daughter Claudia, “he probably thought she wouldn’t have any support system and they could just get the money. A real shyster.”

Thanks to the fast work of Ms. Ellis’ daughter and granddaughter to file the appropriate documents with the bank, Ms. Ellis started receiving her retirement funds again in a few days.

As for the unpaid bill, the attorney tried to argue that Ms. Ellis had received it – which was simply untrue. “He just lied,” Ms. Ellis said. “It was terrible.” Community Health Advocates accompanied her to her latest hearing in September 2021, and was able to help get her case discontinued and her funds no longer pursued for garnishment. “Had they billed the right insurance in a timely fashion, they could’ve gotten paid.” Said Claudia. “Now, they didn’t get a dollar.”

“We Can’t Just Tell Everybody About That” – Sheryl’s Financial Assistance Story

“As someone struggling with medical bills myself, it became my mission to make sure everyone knew about financial assistance.”

A patient navigator for ACR Health and helpline volunteer with Community Health Advocates, Sheryl knows firsthand how challenging it can be to access the funds New York hospitals are legally required to provide to low-income patients.

are legally required to provide to low-income patients.

One case in particular stands out. A man and a woman Sheryl helped enroll in Medicaid were still unable to make payments on their bills. When Sheryl called the hospital’s billing department to ask why they hadn’t received financial assistance, the response was: “We can’t just tell everybody about that. Frustrated, Sheryl responded, “Well, you’re supposed to!”

All New York hospitals are charities under state law, meaning they receive billions of dollars to cover uninsured low-income patients. Still, New York’s nonprofit hospitals have sued over 52,000 patients for medical debt in the past five years — and reviews of these court files indicate that few patients were informed of or offered financial assistance.

For Sheryl, the fight to access these funds is personal as well as professional. In addition to helping others, she has dedicated herself to staying active for her mental and physical health, particularly in the Upstate New York winter. When I spoke with her, the snow was just starting to thaw from the -20 degree weather earlier that week in her home county of St. Lawrence.

When breast cancer struck at 47 years old, however, Sheryl was caught off-guard. Having come in for a follow-up visit during a short gap in coverage before her new employer-sponsored insurance kicked in, she became responsible for the full cost of her care.

Rather than offer financial assistance she was eligible for, her hospital’s billing department suggested a non-profit organization cover her care. “That proved to me that they aren’t using financial assistance either. It’s not offered, suggested or posted.”

Sheryl urged other patients with unaffordable medical bills to either pester their hospital, or find someone who will. “I know from experience – bills pile up and I didn’t have the energy to deal with them. Now working at ACR Health and CHA, I can fight for someone while empathizing with them truly.”

When asked her opinion on New York’s health system, Sheryl said: “We all deserve quality health care. It should be affordable, and it can be – if the system is used effectively.”

To read more medical debt stories and share your own, visit CSS’ We The Patients project.

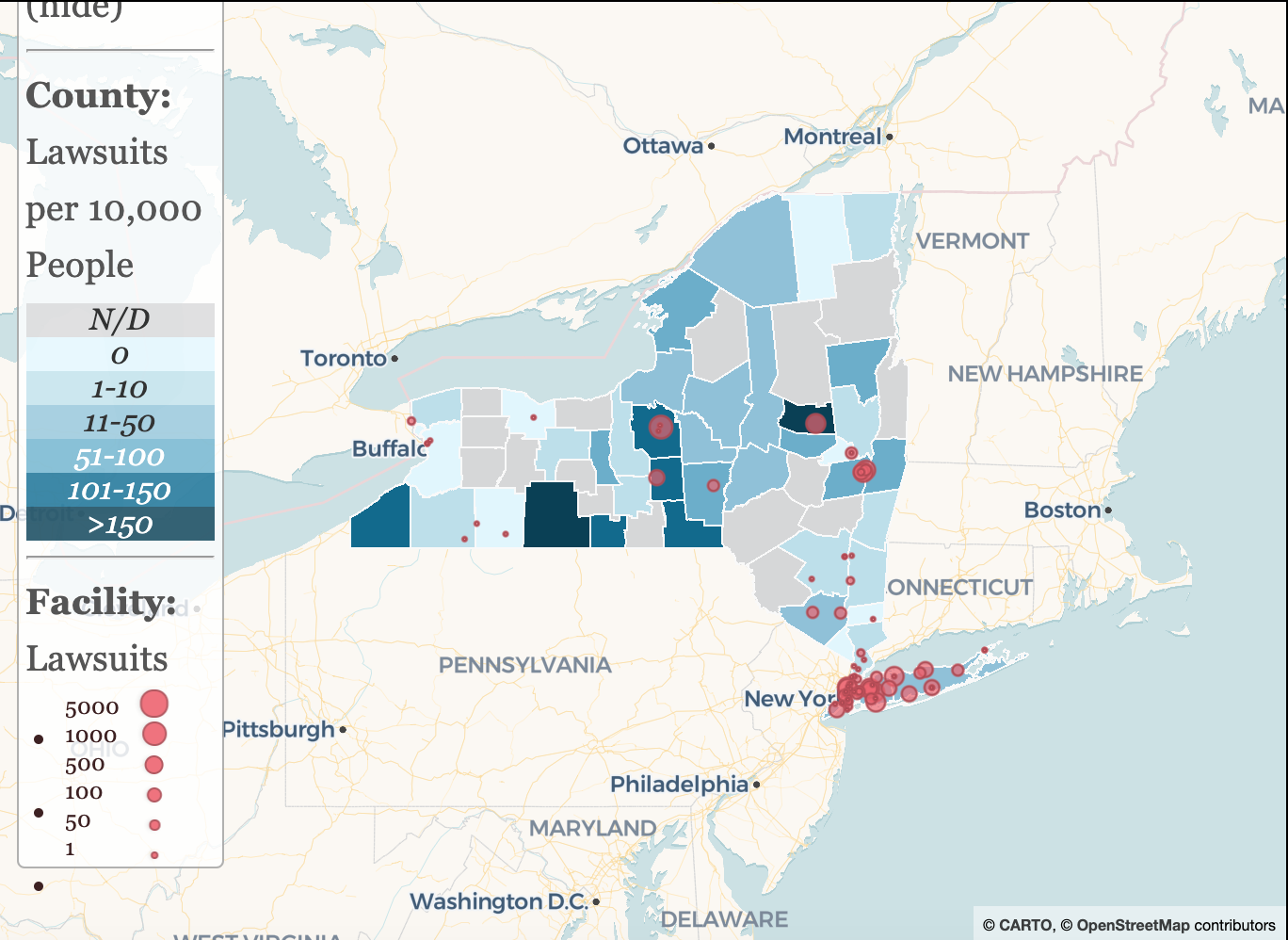

Mapping How New York's Hospitals Sue Vulnerable Patients

New York State hospitals are all nonprofit charities – but that hasn’t stopped some of them from suing their patients for small outstanding medical debts. CSS has scoured court records for medical debt lawsuits from all of New York’s 210 hospitals, plus the five state-run facilities, in all 62 counties. In total, we have identified more than 80,000 lawsuits brought by non-profit hospitals from 2015 to 2023 and state-run hospitals from 2019 to 2023.

Use our mapping resource to find out how your local hospital stacks up.

An Ounce Of Prevention: Reforming the Hospital Financial Assistance Law Could Save Pounds of Patient Debt

As patients continue to get sued for medical debt, New York's Hospital Financial Assistance Law (HFAL) needs urgent reform. Uneven implementation and enforcement of the HFAL leaves uninsured low-income patients and patients of color with medical debts that they cannot pay, contributing to economic insecurity and poor health outcomes.

This brief explains how the Ounce Of Prevention Act would create a fairer, more equitable system for patients in New York by streamlining and modernizing the HFAL.

Related Press:

Medical debt reform requires changes to New York hospital financial aid policies, report says, by Amanda D'Amrosio and Jacqueline Neber, Crain's New York

Discharged Into Debt: Hospital Profile - Upstate University Hospital

This brief describes the medical debt collection practices conducted by Upstate University Hospital (Upstate Hospital), located in Syracuse, New York. At 750 beds, it is the largest medical center in Central New York—and seeks to become even bigger by acquiring the 465 bed Crouse Hospital, located nearby.

In October 2022, the U.S. Federal Trade Commission advised the State Department of Health (SDOH) to reject the proposed merger on the grounds that it will drive higher costs, lower quality of care, and reduce access to care and worker wages. Another consideration that the SDOH should consider is that Upstate Hospital sues more patients for medical debt than any other hospital in the state—as many as 1,500 patients a year.

Discharged Into Debt: New York's Nonprofit Hospitals Garnish Patients' Wages

This final report in the Discharged Into Debt series investigates the practice of nonprofit hospitals garnishing patients' wages after suing them for medical debt. A random sample of 1,611 wage garnishment cases from 5 New York hospitals indicates that the indebted patients work in low-wage occupations such as health care and social services, manufacturing, and retail.

A bill recently passed in the New York State legislature (S6522A/A7363A) would ban hospitals from garnishing patients' wages or imposing liens on their primary residence. This bill awaits Governor Hochul's signature, and we urge her to sign it immediately.

Related Press:

Nonprofit New York hospitals keep suing patients for their wages. Gov. Kathy Hochul has a chance to end it, by Caroline Lewis, Gothamist

Report: Some aggressive hospitals in New York are garnishing wages of poor patients, by Susan Arbetter, Spectrum News 1

Discharged Into Debt: Nonprofit Hospitals File Liens on Patients' Homes

This report examines how New York’s nonprofit hospitals secure liens against patients’ homes in the wake of a medical debt judgment, jeopardizing both the physical and fiscal health of their patients. Between 2017 and 2018, 56 hospitals imposed 4,880 liens on the homes of their patients with outstanding medical bills while collecting over $442 million in state funds (called the Indigent Care Pool) to support their provision of uncompensated care.

Research described in this report indicates that medical debt is strongly associated with housing insecurity, which in turn is related to poor health outcomes. In recognition of the importance that home ownership plays in the health and economic security of their residents, 10 states have laws that bar hospitals and other creditors from securing liens against primary residences. In New York, a bill to protect patients’ homes from aggressive medical debt collectors is pending in the state legislature (S6522/A7363)—and its passage is long overdue.

Related Press:

Hospitals must stop placing liens on medical debtors’ homes, by Daily News Editorial Board, NY Daily News

NY should ban liens on patients’ homes over medical debts, by Advance Media NY Editorial Board, Syracuse.com

Report: Local hospitals filed hundreds of liens on patient homes over medical debt, by Bethany Bump, Albany Times-Union

3 CNY hospitals played hardball with patients who owe money by slapping liens on their homes, by James T. Mulder, Syraucse.com

Discharged Into Debt: Medical Debt and Racial Disparities in Albany County

This brief examines the medical debt crisis in Albany County. Not only do 12 percent of Albany residents have delinquent medical debt on their credit reports, but there are profound racial disparities related to who is in debt. While 10 percent of white residents have medical debt, two and half times—or 26 percent—of residents of color have medical debt in Albany.

Compounding the problem, Albany County is a New York State medical debt litigation hotspot. Between 2015 and 2020, five nonprofit charitable hospitals sued 2,900 Albany residents.2 Not even the once-in-a-century pandemic proved to be a deterrent.

Related Press:

Number of patients sued by Capital Region hospitals over unpaid bills among highest in NY, by Briana Supardi, WRBG Albany

Pandemic hasn't stopped area's hospitals from suing patients over unpaid bills, by Bethany Bump, Albany Times-Union

Pandemic hasn't stopped area's hospitals from suing patients over unpaid bills, by Katie Adams, Becker's Hospital Review

Discharged Into Debt: A Pandemic Update

Even during the COVID-19 pandemic, many of New York's non-profit charitable hospitals did not stop suing patients. From March to November 2020, 55 hospitals sued nearly 4,000 New Yorkers for medical debt.

This brief investigates the medical debt collection practies used by these hospitals. The lawsuits were brought even though these hospitals received millions of dollars—in some cases hundreds of millions—in government funding to offset their losses during the pandemic. Litigation against patients occurred across the state, however the predominately downstate Northwell system was the most litigious.

Policymakers have several policy options at their disposal—a moratorium on all medical debt litigation and the Patient Medical Debt Protection Act—that would insulate patients from these aggressive medical debt collection practices.

Related Press:

Pandemic Profiteers: Hospitals Sued Patients over Medical Debt While Getting Billions in Relief Aid, Democracy Now!

One Hospital System Sued 2,500 Patients After Pandemic Hit by Brian M. Rosenthal, The New York Times

This Week's Biggest Winners and Losers, City & State

Squawk on the Street: Michael Dowling, CNBC

Medical Debt and the Pandemic, The Brian Lehrer Show on WNYC

Breaking Down Cuomo's State of the State health care proposals by Tim Williams, WCNY

Northwell Health Promises to Stop Suing Patients Over Unpaid Medical Bills During Pandemic by Sydney Pereira, Gothamist

Northwell Health Says It Will Stop Suing Patients During Pandemic by Tara Bannow, Modern Healthcare

CSSNY's Benjamin on Charitable Hospitals Suing Patients During COVID-19 by Susan Arbetter, Spectrum News

Because of Surge in Covid-19 Cases, Northwell Hits Pause on Bill Collections by David Olson and Craig Schneider, Newsday

Northwell's 2,500 Lawsuits Against Patients Made Headlines; Hours Later, They Were Rescinded by Alia Paavola, Becker's Hospital Review

Discharged Into Debt: New York's Nonprofit Hospitals Are Suing Patients

All of New York's hospitals are nonprofit, charitable institutions. So why are they suing patients over small outstanding medical bills? In response to consumer complaints about increasingly aggressive collection practices used by nonprofit hospital systems, CSS reviewed nearly 31,000 civil cases filed against individual patients by 139 hospitals in 26 counties.

We found that the hospitals who sue the most patients provide insufficient financial assistance and rely on professional debt collection law firms to go up against patients who are largely unrepresented.

Here's more from CSS VP of Health Initiatives Elisabeth Benjamin on how New York's nonprofit hospitals have been dishcarging patients into debt from the 2020 Full Participation Is A Human Right Conference.

How Structural Inequalities In New York's Health Care System Excaerbate Health Disparities During The COVID-19 Pandemic: A Call For Equitable Reform

Researchers and the media have extensively documented that people of color are more likely than white people to be exposed to COVID-19, require hospitalization, and die. But few reports have illuminated the historical and structural health policy decisions that form the underpinnings of the immense disparities witnessed in New York, the epicenter of the U.S. pandemic.

This issue brief describes the cumulative impact of these decisions—particularly health policy and financing decisions in New York in the last 30 years—and proposes recommendations for addressing them moving forward.

2024

Syracuse.com, 1/2/2024: Hochul proposes law to stop hospitals like Upstate from suing poor patients over unpaid bills

Gothamist, 1/3/2024: Hochul wants to ban insulin copays for some New Yorkers. Insurers are already pushing back.

The New York Times, 1/22/2024: 500,000 New Yorkers Could Have Medical Debt Erased Under New Program

Crain’s Health Pulse, 1/23/2024: Experts applaud city’s $18M commitment to relieve medical debt but urge lawmakers to address root causes

Politico Pro, 1/25/2024: Hospital Costs Feature in 2024 Policy Agendas

Albany Times Union, 2/5/2024: LTE: Hochul’s plan to ban co-pays for insulin right move

The Daily Orange, 2/20/2024: Citizen Action of New York holds ‘End Medical Debt’ forum, explains ‘root’ of the problem

CNY Central, 2/20/2024: Advocates push to ban hospitals from suing patients for medical debt in New York

WAER 88.3, 2/20/2024: Advocacy groups, patients call for reforms to address medical debt

Spectrum News, 2/22/2024: New York state senator seeks ban on hospital lawsuits against patients

Crain’s Health Pulse, 2/23/2024: City’s plan to wipe medical debts won’t clear H+H bills, FDNY ambulance dues

2023

Democracy Now, 1/18/2023: “End Medical Debt: Fight Grows to Stop Hospitals from Suing Patients, Garnishing Wages, Ruining Credit”

Truthout, 1/18/2023: ”Fight Grows to Stop Medical Debt From Destroying Patients’ Lives”

Free Speech TV, 1/18/2023: “End Medical Debt: The Fight to Stop Hospitals from Suing Patients, Garnishing Wages, Ruining Credit”

Nonprofit Quarterly, 1/24/2023: “Eliminating Healthcare Debt: A Liberatory Approach”

Long Island Press, 2/5/2023: “OpEd: Public Money Should Be Used for Public Good in New York’s Hospital System”

New York Focus, 2/9/2023: “Hochul Ditched Health Insurance Promise to Undocumented New Yorkers”

Times Union, 3/15/2023: "Commentary: Medical debt can trap anyone. The state has a chance to help.”

Gothamist, 3/23/2023: “Ambulance rides are a major cause of medical debt. FDNY still wants to raise the cost.”

News 12 Brooklyn, 3/24/2023: “FDNY holds public hearing on proposed ambulance rate hike”

Politico, 3/27/2023: “Safety-net providers sue to stop Medicaid carveout”

Crains, 3/27/2023: “FDNY proposes largest price hike for city ambulance services in two decades”

Long Island Press, 3/28/2023: “OpEd: New York Should Expand Health Coverage and Tackle Medical Debt”

Riverdale Press, 3/31/2023: “Health care trends bleak under insurance system”

AP, 4/13/2023: “States confront medical debt that’s bankrupting millions”

KFF News, 4/20/2023: “Lose Weight, Gain Huge Debt: NY Provider Has Sued More Than 300 Patients Who Had Bariatric Surgery”

Crain’s, 4/25/2023: “Medical debt reform requires changes to New York hospital financial aid policies, report says”

Capitol Pressroom, 5/16/2023: “Medical debt persists for thousands of New Yorkers”

Syracuse, 5/18/2023: “SUNY Chancellor weighs in on Upstate, other NY hospitals’ high rate of suing over unpaid bills”

The American Prospect, 5/26/2023: “Hospitals’ Bid for Quick Cash Leaves Patients Worse Off”

Capitol Pressroom, 6/1/2023: “Policymakers inch toward ‘coverage for all’”

New York Focus, 6/7/2023: “Feds Would Likely Foot The Bill For Undocumented Health Coverage. Albany Has Days to Act”

The Wall Street Journal, 6/15/2023: “How to Fight Back When Your Health Insurance Won’t Cover Treatment”

Spectrum News, 6/20/2023: “New York could change how medical debt impacts consumers”

Democracy Now, 6/21/2023: “NY Dems Pass Medical Debt Relief as Progressives Push to Expand Healthcare to Undocumented Residents”

Truthout, 6/21/2023: “Health Care Advocates Celebrate Passage of Medical Debt Relief in New York”

Free Speech TV, 6/21/2023: “NY Dems Pass Medical Debt Relief as Progressives Push to Expand Healthcare to Undocumented Residents”

Democrat and Chronicle, 6/22/23: “NY greenlights bill keeping medical debt from harming credit reports. What it means”

Lohud, 7/12/23: “Some NY hospitals nixed medical debt lawsuits. Others sued 1,600 patients for $9M”

Crain’s Health Pulse, 7/26/23: “Q&A: Nonprofit leader on the ‘Herculean’ effort to maintain Medicaid coverage for New Yorkers”

New York Post, 7/30/23: “NYC launches program to wipe out millions of dollars in patients’ medical debt”

Spectrum Local News, 7/31/2023: STUDY: Upstate Rural New Yorkers of Color Face the Most Medical Debt

Spectrum News, 10/12/2023: Medical debt impacts at least 740,000 New Yorkers

Syracuse.com, 10/17/2023: 1 in 4 Syracuse adults struggle with medical debt, the most among NY’s big cities, study says

Crain’s Health Pulse, 10/24/2023: Lawmaker introduces bill to stop state-run hospitals from suing patients for medical debt

LoHud, 10/24/2023: Medical debt plagues 1 in 3 adults in this upstate city. How big of a problem is it in NY?

New York Focus, 10/27/2023: Despite State Measures, New Yorkers Fear Health Care Over Medical Debt Lawsuits

The Daily Beast, 11/10/2023: Getting an Itemized Hospital Bill Is Basically Impossible

Yahoo Finance, 11/18/2023: Medical debt: New federal rules could provide credit relief for millions of Americans

KFF Health News, 12/13/2023: New Yorkers’ Credit Reports Will No Longer Reflect Medical Debt

AP News, 12/13/2023: New York removes medical debt from credit reports

Governor’s Pressroom, 12/13/2023: Governor Hochul Signs Four New Laws to Protect Consumers from Price Gouging, Medical Debt and Unfair Business Practices

CBS News, 12/13/2023: New York joins Colorado in banning medical debt from consumer credit scores

ABC News, 12/13/2023: New York removes medical debt from credit reports

NY State of Politics, 12/13/2023: Hochul signs bills into law on medicine price gouging, medical debt

Bloomberg Law News, 12/13/2023: Hochul Signs Bill Banning Medical Debt From NY Credit Reports

Democrat and Chronicle, 12/13/2023: New NY law prohibits reporting medical debt to credit agencies

Bronx News, 12/13/2023: Gov. Hochul signs bills relieving New Yorkers from medical debt woes

Syracuse.com, 12/13/2023: Medical debt can no longer hurt your credit score in New York

The Daily Gazette, 12/13/2023: Hochul signs bills addressing medical debt, subscription services

Syracuse.com, 12/14/2023: How NY state, Upstate Medical haul thousands of sick and poor into court for little gain

Crain’s Health Pulse, 12/14/2023: Hochul signs bills to protect New Yorkers from the consequences of medical debt and expensive medications

KFF Health News – An Arm and a Leg, 12/14/2023: When Hospitals Sue Patients (Part 1)

Syracuse.com, 12/17/2023: NY’s public hospitals should stop suing low-income patients over medical debts (Editorial Board Opinion)

Crain’s Health Pulse, 12/20/2023: New York state asks feds to expand Essential Plan coverage to DACA recipients

Crain’s Health Pulse, 12/21/2023: Hochul spotlights access, protection and transparency in latest health care bills signed

2022

The Buffalo News, 8/23/2022 “The Editorial Board: Hospitals should help low-income patients, not sue them”

Syracuse.com, 10/12/2022: “It’s time to end medical debt in Syracuse (Guest Opinion by Ursula Rozum)”

Capitol Pressroom, 10/14/2022: “Consumer Protections Eyed For Health Care System”

New York Daily News, 10/14/2022: “Protect working class N.Y. from medical debt”

The New York Times, 10/20/2022: “The Mysterious Patient in Room 23: The Hermit Baroness”

LoHud, 11/29/2022: “NY ends home liens, wage garnishments in medical-debt collection. What you should know.”

WSKG, 11/29/2022: “New York hospitals can no longer place liens, garnish wages due to medical debt”

Newsday, 12/5/2022: “Patients with medical debt will no longer have wages garnished, liens placed on homes”

WAMC, 12/9/2022: “Capital Region advocates call for end to medical debt”

We've already achieved some big victories for patients:

We've already achieved some big victories for patients:

-

Updating the state Hospital Financial Assistance law to increase eligibility and discounts, eliminate asset tests, prohibit lawsuits against patients with income below 400% FPL, and require all hospitals to provide financial assistance.

-

Eliminating cost-sharing for insulin for state-regulated plans.

-

Banning credit reporting agencies from collecting information about or reporting on medical debt.

-

Stopping medical providers from garnishing patients’ wages or placing liens on their homes to collect medical debt judgments.

-

Requiring hospitals and their affiliated providers to notify patients in advance if they charge facility fees and banning the fees for preventive care.

-

Requiring all hospitals to use a unified hospital financial assistance form provided by the State Department of Health.

-

Cutting the judgment interest rate from 9 percent to 2 percent.

-

Ensuring that emergency rooms comply with the no surprising billing protections under state law.

-

Reducing the statute of limitations for medical debt court cases from six years to three years.

-

Eliminating a loophole in the state’s surprise medical billing law that excluded some hospital bills.

-

A New York Times story that convinced Northwell Health to stop suing patients during the pandemic and rescind the 2,500 lawsuits it had already filed.

Support our campaign so we can continue pushing for a fairer, more equitable health system.

Use the map below to learn more about how your local hospital treats patients with medical debt.

Map updated February 2024. This map was supported and co-created by BetaNYC through the use of BetaNYC's RADAR system.

Data on civil court cases was retrieved from eCourts, a resource created by the New York State Unified Court System. Data on state-run facilities was retrieved from the New York State Courts Electronic Filing Supreme Civil Court database. Data on indigent care pool funding was provided by the New York State Department of Health. Data on the amount hospitals spent on financial assistance was retrieved from the hospitals’ Institutional Cost Reports, filed annually with the New York State Department of Health. The windfall amounts reported on the map are the difference between what the hospital received from the state’s indigent care pool and the amount they reported spending on financial assistance for uninsured patients. For more information about the methodology, see our report Discharged Into Debt. State-run facility lawsuit totals are cumulative from 2019 to 2023. Non-profit hospital lawsuit totals are cumulative from 2015 to 2022 with 2023 cases included for all hospitals that sued patients for medical debt in the previous seven years.

An earlier version of this analysis by Amanda Dunker was published in June 2020.

New York State hospitals are all nonprofit charities – but that hasn’t stopped some of them from suing their patients for small outstanding medical debts. In March of 2020, CSS analyzed hospitals in 26 out of 62 New York counties and uncovered more than 30,000 lawsuits against patients since 2015. Since then, we’ve completed the search for all of New York’s 210 hospitals, plus the five state-run facilities, in all 62 counties – and the results are in!

Searching public court records, this research identified a universe of more than 80,000 hospital lawsuits brought by non-profit hospitals since 2015 and state-run hospitals since 2019. The disproportionately large volume of cases brought by state-run facilities required CSS to limit its analysis of their cases to those filed since 2019. The five state-run facilities are responsible for over 20 percent of all medical debt lawsuits, despite this limit on the search timeframe. By contrast, most of the 210 other hospitals in New York State do not sue their patients at all or only do so very rarely. Nationally and in New York, many hospitals are discontinuing or reducing the practice of suing patients or erasing patients’ medical debt.

The five state-run facilities alone have filed over 16,000 lawsuits since 2019, representing 20 percent of all medical debt suits. These state-run facilities receive over $530 million annually in federal Disproportionate Share Hospital funding which is supposed to support their uncompensated care costs. CSS research found that SUNY Upstate, for example, disproportionately sued patients who live in low-income communities of color – even 12 patients who were incarcerated and demonstrably had no means to pay their bills.

Our Discharged Into Debt series of reports takes a closer look at these alarming lawsuits against patients and finds some disturbing trends. New York hospitals receive billions of dollars in state support each year, including over $1 billion in Indigent Care Pool funds, designed to support the provision of financial assistance to low- and moderate-income New Yorkers. Yet we found that the hospitals that sue the most patients routinely keep these ICP funds instead of offering financial assistance to patients, thus pocketing a windfall. Our reports also found that nonprofit hospitals often disproportionately sue patients of color, aggressively sued patients at the height of the pandemic, garnished the wages of low-wage workers, and took liens on patients’ homes.